Цитата Джареда Бернштейна

Было бы ошибкой думать, что любое повышение заработной платы связано с инфляцией, и есть значительные возможности для неинфляционного роста заработной платы, особенно в нижней части шкалы.

Связанные цитаты

Резкое повышение минимальной ставки заработной платы также вызывает инфляцию. Часто рабочие платили больше минимального размера своей заработной платы по отношению к ней. Особенно это касается тех работников, у которых почасовая оплата. Таким образом, увеличение минимума увеличивает их требования к более высокой заработной плате, чтобы сохранить свое место в структуре заработной платы. И когда рост будет столь же резким, как в HR 7935, результатом обязательно будет новый всплеск инфляции.

Если существует рынок низкооплачиваемой работы, то нам следует подумать о том, как сделать этот вид работы более привлекательным, предоставив государственную помощь. Конечно, наемный работник должен иметь возможность жить за счет своей заработной платы. Мы не допустим нищенской заработной платы или демпинговой заработной платы. Но наемный работник может получать комбинированную заработную плату, которая включает в себя как его фактическую заработную плату, так и государственную субсидию.

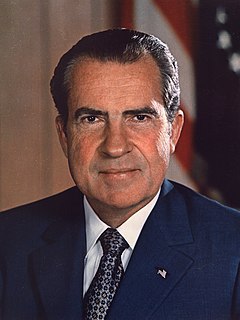

Вы знаете, у меня есть опыт, восходящий к контролю над ценами на заработную плату в администрации Никсона, где, по сути, мы допустили то, что я считаю ужасной ошибкой, в этом случае республиканская администрация, которая вмешалась и попыталась контролировать заработную плату. , цены и прибыль каждого предприятия в Америке. Это была огромная ошибка.

Сдерживая предложение рабочей силы на низком уровне, иммиграционная политика имеет тенденцию поддерживать высокий уровень заработной платы. Подчеркнем этот основной принцип: можно ожидать, что ограничение предложения любого вида труда по отношению ко всем другим производственным факторам повысит его ставку заработной платы; а увеличение предложения, при прочих равных условиях, приведет к снижению ставок заработной платы.

Предприятия с большим объемом активов, как правило, приносят низкую норму прибыли - ставки, которые часто едва обеспечивают достаточно капитала для финансирования инфляционных потребностей существующего бизнеса, при этом не остается ничего для реального роста, для распределения среди владельцев или для приобретения новых предприятий.

Если бы сегодняшняя экономика функционировала на уровне, близком к уровню потенциала, с небольшой безработицей, или если бы внезапное изменение наших военных потребностей вызвало бы борьбу за людей и ресурсы, тогда я бы выступил против снижения налогов как безответственного и инфляционного; и я без колебаний рекомендовал бы увеличить налоги, если бы это было необходимо.