A Quote by Jamie Dimon

Abenomics, quantitative easing, fiscal policy - we know all the issues.

Quote Topics

Related Quotes

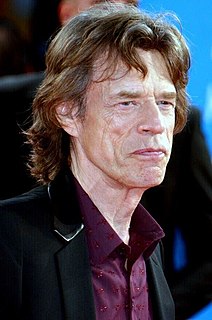

I like Mitch Daniels on the fiscal conservative issues. You disagree with him on this idea that social issues, you takeoff the table. I do that for two reasons. I think the fiscal issues in a sense are a symptom of a lot of the deeper cultural issues in America. I don't think they are as disconnected as he thinks.

There is a big divergence between views on a variety of policy issues from fiscal stimulus to financial regulation. It's my hope and my ambition for the economics profession that as we advance our knowledge, that those discussions will narrow in their focus, and that it will help to have more prudent policy-making down the road.