A Quote by Jamie Dimon

If you talk to anyone involved in business - forget banks and big business - talk to small businesses - do it yourself, don't ask me - they'll tell you it's crippling. Small-business formation is the lowest it has ever been in a recovery, and it's really for two reasons. One is regulations and the second is access to capital for people starting new businesses.

Quote Topics

Related Quotes

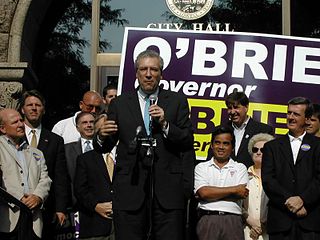

Our party [Republicans] has been focused on big business too long. I came through small business. I understand how hard it is to start a small business. That's why everything I'll do is designed to help small businesses grow and add jobs. I want to keep their taxes down on small business. I want regulators to see their job as encouraging small enterprise, not crushing it.

When I talk about the ability for fintech to promote kind of economic growth and productive citizens coming in, using different data and being able to lend to small businesses, see those small businesses start to grow - of course, that means more money for their families, you know, the small-business owner families. They start to hire people.

While big business gain subsidies and political access, small businesses drown in red tape, and individuals now risk being classified as terrorists for complaining about it. Economic globalisation is about homogenising differences in the worlds' markets, cultures, tastes and traditions. It's about giving big business access to a global market.

And fifth, we will champion small businesses, America's engine of job growth. That means reducing taxes on business, not raising them. It means simplifying and modernizing the regulations that hurt small business the most. And it means that we must rein in the skyrocketing cost of healthcare by repealing and replacing Obamacare.

Congress can protect small businesses by providing effective oversight over SBA policies and make sure they take into account the needs of small businesses while also protecting taxpayer dollars. Congress also needs to make sure that new banking regulations do not make it more costly for community banks to lend to small businesses.