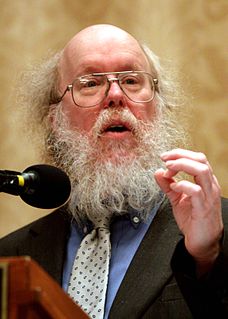

A Quote by James Bovard

However accurate or inaccurate the agency's numbers may be, tax law explicitly presumes that the IRS is always right -- and implicitly presumes that the taxpayer is always wrong -- in any dispute with the government. In many cases, the IRS introduces no evidence whatsoever of its charges; it merely asserts that a taxpayer had a certain amount of unreported income and therefore owes a proportionate amount in taxes, plus interest and penalties.

Related Quotes

Congress is supposed to fund the IRS, and it has been steadily reducing the number of auditors and tax collectors the IRS has at the very time that the tax system has become vastly more complicated. And of course America continues to grow, so there's an increasing number of tax returns coming in. The IRS responds by doing exactly what Congress expects of them. That shouldn't surprise anyone. All bureaucracies do what they are told.

Much has already been learned about the arrogance of the IRS from the House investigations of the agency's targeting of conservatives. The revelations emerged despite strenuous efforts by Democrats in Washington and by the IRS itself to block inquiries and deny the existence of political targeting - targeting that the former head of the IRS Exempt Organizations Unit, Lois Lerner, eventually acknowledged and apologized for in May 2013.

If you look at the performance of the zero-income-tax-rate states and the highest-income-tax-rate states, I believe a large amount of their difference is due to taxes. Not only is it true of the last decade, but I took these numbers back 50 years. And, there's not one year in the last 50 where the zero-income-tax-rate states have not outperformed the highest-income-tax-rate states.

In 1848, Karl Marx said, a progressive income tax is needed to transfer wealth and power to the state. Thus, Marx's Communist Manifesto had as its major economic tenet a progressive income tax. ... I say it is time to replace the progressive income tax with a national retail sales tax, and it is time to abolish the IRS.