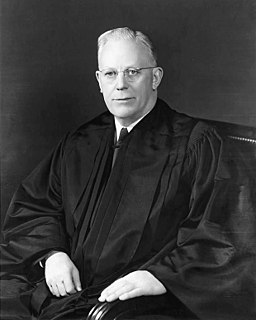

Цитата Джеймса Дугласа

Я взял на себя обязательство, что государственные расходы в Вермонте не будут расти больше, чем уровень инфляции плюс прирост населения.

Связанные цитаты

Темпы роста соответствующего населения намного выше, чем темпы роста фондов, хотя фонды выросли очень хорошо. Но мы выпускаем студентов быстрыми темпами; они конкурируют за средства, и поэтому они более разочарованы. Я думаю, что есть определенное чувство усталости в интеллектуальной сфере, это никоим образом не свойственно экономике, это общее положение.

Существенные изменения в темпах роста денежной массы, даже небольшие, в первую очередь влияют на финансовые рынки. Затем они влияют на изменения в реальной экономике, обычно через шесть-девять месяцев, но в диапазоне от трех до 18 месяцев. Обычно примерно через два года в США они коррелируют с изменениями темпов инфляции или дефляции». изменение роста денежной массы и последующее изменение инфляции.

Инфляция всегда и везде является денежным явлением в том смысле, что она возникает и может быть вызвана только более быстрым увеличением количества денег, чем объема выпуска... Устойчивый темп роста денежной массы на умеренном уровне может обеспечить основу для что в стране может быть небольшая инфляция и большой рост. Это не даст идеальной стабильности; он не произведет рая на земле; но он может внести важный вклад в стабильное экономическое общество.

Иногда повышение налоговой ставки создает те самые проблемы, которые призваны решить эти расходы. Другими словами, повышение налоговой ставки снижает экономический рост; они уменьшают размер пирога; они вызывают большую бедность, большее отчаяние, большую безработицу, и все это правительство пытается уменьшить с помощью расходов.

С 2008 по 2016 год весь рост американской экономики, весь рост национального дохода был заработан только самыми богатыми 5% населения. Вот они и получили весь рост. 95% населения не выросло. Если вы сможете получить фиксированный налог или другой более низкий налог, как предлагает Трамп, то эти самые богатые 5% смогут сохранить еще больше денег. Это означает, что 95% будут еще беднее, чем были раньше, по отношению к самому верху.

Ибо, конечно, никто не может быть в безопасности, когда любит. Рост требует усилий и может показаться опасным, поскольку в росте есть и потери, и выгоды. Но зачем продолжать жить, если человек перестал расти? А что может быть более требовательной атмосферой для роста, чем любовь в любой форме, чем любые отношения, которые могут вызвать и потребовать от нас нашего самого сокровенного и самого глубокого «я»?

Я скажу так: центральные банки действительно могут поддерживать рост сверх определенной точки. Когда нет инфляции, они могут снижать процентные ставки, и таким образом они поддерживают рост, но если вы урезаете процентные ставки до костей, сокращать больше нечего. Очень трудно поддерживать рост сверх этого.

Многие сельскохозяйственные округа имеют гораздо большее значение в жизни штата, чем их население имеет для всего населения штата. Именно по этой причине я никогда не был сторонником ограничения их представительства в сенате нашего штата исключительно населением. По той же причине отцы-основатели нашей страны обеспечили сбалансированное представительство штатов Союза, равное представительство в одной палате и пропорциональное представительство в зависимости от численности населения в другой.