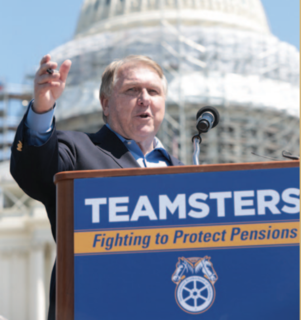

Цитата Джеймса П. Хоффа

Уклонение от корпоративного налогообложения влияет на нас из поколения в поколение и с течением времени. Это вызывает коррозию. Это неэтично. Это неустойчиво.

Связанные цитаты

Исследования показали, что наемные работники со средним доходом больше всего выиграют от значительного снижения ставок корпоративного налога. Корпоративный налог — это не налог на богатых. Корпорации даже не платят. Они просто облагают налогом более низкую заработную плату и льготы, более высокие потребительские цены и меньшую акционерную стоимость.

Вы должны помнить, что S-корпорации платят один уровень налога, корпорации платят два уровня налога. Таким образом, мы в основном видим эквивалент, но вот в чем суть. В остальном мире они облагают свой бизнес налогом по средней ставке в промышленно развитых странах 23 процента. Наш корпоративный рейтинг составляет 35. Наш лучший корпоративный показатель S для малого бизнеса составляет 44,6. Это убивает нас.

Не дай Бог, чтобы Великобритания взяла на себя инициативу и ввела собственную разумную налоговую систему, которая, вероятно, включала бы очень низкий уровень корпоративного налога — налога на прибыль корпораций — и, возможно, низкий уровень налога с продаж корпораций, потому что именно продажи они есть, и продажи в этой стране — это продажи здесь, которые мы можем здесь облагать налогом.

Я поддерживаю как справедливый налог, так и план фиксированного налога, который значительно упростит налоговую систему. Справедливый налог заменит все федеральные налоги на личный и корпоративный доход единым национальным налогом на розничные продажи, в то время как фиксированный налог будет применять ту же налоговую ставку ко всем доходам с небольшими вычетами или исключениями, если таковые имеются.

Африканские страны больше всего теряют от уклонения от уплаты налогов. Поэтому правительства африканских стран должны сделать больше, чтобы добиться полной реформы глобальной налоговой системы и потребовать действий от таких стран, как Великобритания, чьи финансовые центры находятся в центре глобальной сети налоговых убежищ.

Нам нужно снизить налоговые ставки для всех, начиная с максимальной ставки корпоративного налога. Нам нужно упростить налоговый кодекс. Окончательным ответом, на мой взгляд, является справедливый налог, который является справедливым налогом для всех, потому что, пока у нас все еще есть этот запутанный налоговый кодекс, политики будут использовать его для вознаграждения победителей и проигравших.

Мы должны помнить, что левые — это люди, которые создали неустойчивый государственный долг, неустойчивое медицинское страхование, здравоохранение, неустойчивое обучение в колледже и долги, неустойчивые программы социального обеспечения. Все, что создают левые, неустойчиво, так не может продолжаться. Все, что они создают, в конце концов взорвется, потому что не может работать так, как они задумали. Ничто из того, что они делают, не является устойчивым. Это великая ирония. Но они утверждают, что знают, как поддерживать жизнь такой, какой мы ее знаем.