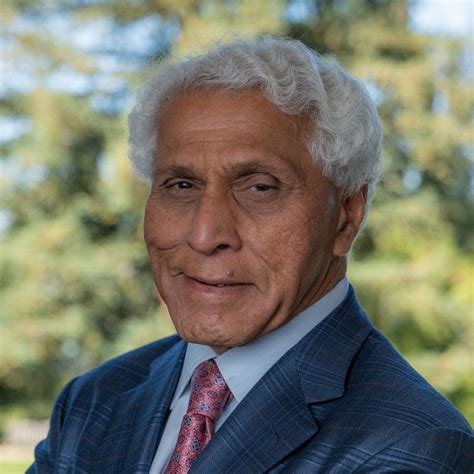

A Quote by Jack Reed

Hedge funds, private equity and venture capital funds have played an important role in providing liquidity to our financial system and improving the efficiency of capital markets. But as their role has grown, so have the risks they pose.

Related Quotes

State funds, private equity, venture capital, and institutional lending all have their role in the lifecycle of a high tech startup, but angel capital is crucial for first-time entrepreneurs. Angel investors provide more than just cash; they bring years of expertise as both founders of businesses and as seasoned investors.

When I was 23, 24, I started covering hedge funds - a lot of this was luck - when no one else did. This was before hedge funds were the prettiest girl in school: this was pre-nose job and treadmill for hedge funds, when nobody talked to them - back then, it was just all about insurance companies and money managers.

I'm struck by the fact that by and large equity capital doesn't play a big role in new financing; it's either bonds or internal financing but not really equity. And therefore, it's not clear that anything which improves the equity markets has really much to do with the productivity of the economy as a whole.