A Quote by Jeremy Grantham

Profit margins are probably the most mean-reverting series in finance, and if profit margins do not mean-revert, then something has gone badly wrong with capitalism. If high profits do not attract competition, there is something wrong with the system and it is not functioning properly.

Related Quotes

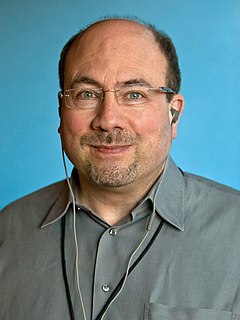

Every time I started a business and the people told me I was an idiot, I ended up making a lot of money. Si Redd used to say me, "Boy, you gotta be where they ain't." What that means is that you find areas of low competition because high competition means lower margins, and lower margins mean less profit. So we were always looking for places where we can be unique. If the thinking is out-of-the-box, people may not understand because they have not seen it before... Therefore you are an idiot.

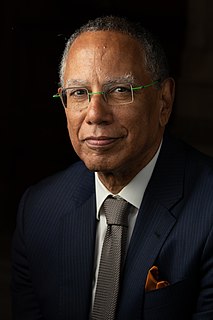

My understanding from talking to a lot of people in the business has been that it used to be that a newspaper was considered a community service. Now they're being run as profit centers, and they're trying to get pretty high profit margins. As a result, investigative reporting has been seen as a problem.

We need to reverse three centuries of walling the for-profit and non-profit sectors off from one another. When you think for-profit and non-profit, you most often think of entities with either zero social return or zero return on capital and zero social return. Clearly, there's some opportunity in the spectrum between those extremes. What's missing is the for-profit finance industry coming in to that area. Look at the enormous diversity of the for-profit financial industry as opposed to monolithic nature of the non-profit world; it's quite astonishing.

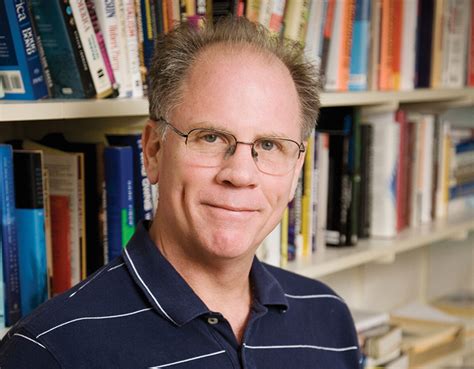

Not yet have I found any better method to prosper during the future financial chaos, which is likely to last many years, than to keep your net worth in shares of those corporations that have proven to have the widest profit margins and the most rapidly increasing profits. Earning power is likely to continue to be valuable, especially if diversified among many nations.

I also don't think all of the revenue will come from digital subscriptions. We have in the New York Times a mix of revenue sources and it will continue to be a mix for quite a while. What makes me more nervous is that we built this newsroom on a really high profit margin that has eroded significantly over the last years. I'm nervous that we won't continue to have the profit margins that allow us to have a big, robust newsroom.

What corporations fear is the phenomenon now known, rather inelegantly, as 'commoditization.' What the term means is simply the conversion of the market for a given product into a commodity market, which is characterized by declining prices and profit margins, increasing competition, and lowered barriers to entry.