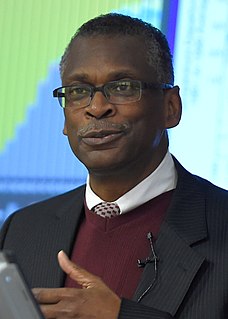

A Quote by Jim Jordan

I am very concerned about anything that says 'revenue' because let's just be honest; revenue for Democrats has become code for tax increases.

Related Quotes

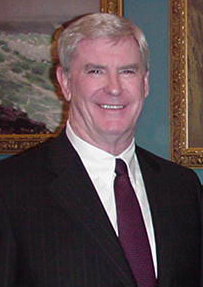

The Democrats and Republicans need to come together. I've criticized Democrats for their unwillingness to address entitlement reform and Social Security and Medicare. Republicans, on the other hand, never saw a tax that they liked, even when it meant closing tax loopholes. They don't want to in any way support any revenue enhancements.

Both ground- rents and the ordinary rent of land are a species of revenue which the owner, in many cases, enjoys without any care or attention of his own. The annual produce of the land and labour of the society, the real wealth and revenue of the great body of the people, might be the same after such a tax as before. Ground-rents, and the ordinary rent of land are, therefore, perhaps the species of revenue which can best bear to have a peculiar tax imposed upon them.

The Joint Committee on Taxation estimated that in 2016, the corporate income tax raised $300 billion in revenue, while what it called 'targeted subsidies' cost about $270 billion. In other words, Congress could eliminate the subsidies and cut the corporate rate nearly in half without any significant loss in revenue.