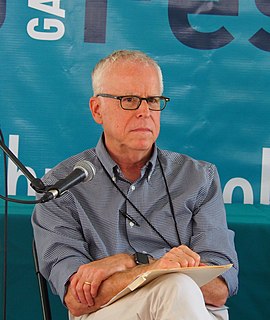

A Quote by Joe Lonsdale

The reason we have so much talent in Silicon Valley building and investing in for-profit technology companies is that markets richly reward successful ideas, no matter who invents them. But to remain competitive in a free market, companies must exercise discipline to meet quantitative goals and eventually become cashflow positive.

Related Quotes

There is more interest in what is occurring in technology companies that impact news. Such companies don't have the same sense of transparency about what they do. They have a tradition of secrecy about products, mores and decision-making that goes along with Silicon Valley and intellectual property and technology. You cannot step onto the grounds of Google without signing a Non-Disclosure Agreement. That industrial secrecy mentality exists along with a theoretical sensibility about transparency on the Web, which is different than transparency inside companies that profit from the Web.

More and more major industries are being run on software and delivered as online services—from movies to agriculture to national defense. Many of the winners are Silicon Valley-style entrepreneurial technology companies that are invading and overturning established industry structures. Over the next 10 years, I expect many more industries to be disrupted by software, with new world-beating Silicon Valley companies doing the disruption in more cases than not.

Today's consumers are eager to become loyal fans of companies that respect purposeful capitalism. They are not opposed to companies making a profit; indeed, they may even be investors in these companies - but at the core, they want more empathic, enlightened corporations that seek a balance between profit and purpose.

The Silicon Valley companies are not understating that they are so politically and socially and culturally central in the world. They would probably never have thought that they would become like this. But now that they are, what are they gonna do about it? I have a lots of friends who work in these companies: it's about taking responsibility.