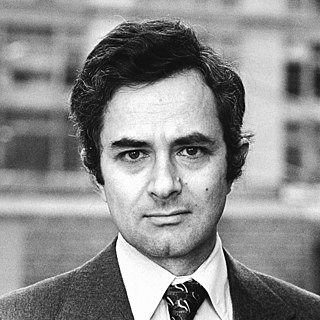

A Quote by Joan Robinson

There is an unearthly, mystical element in Friedman's thought. The mere existence of a stock of money somehow promotes expenditure. But insofar as he offers an intelligible theory, it is made up of elements borrowed from Keynes.

Related Quotes

Investors, of course, can, by their own behavior make stock ownership highly risky. And many do. Active trading, attempts to "time" market movements, inadequate diversification, the payment of high and unnecessary fees to managers and advisors, and the use of borrowed money can destroy the decent returns that a life-long owner of equities would otherwise enjoy. Indeed, borrowed money has no place in the investor's tool kit.

Look, I'm very much in favor of tax cuts, but not with borrowed money. And the problem that we've gotten into in recent years is spending programs with borrowed money, tax cuts with borrowed money, and at the end of the day that proves disastrous. And my view is I don't think we can play subtle policy here.

Keynes was a great economist. In every discipline, progress comes from people who make hypotheses, most of which turn out to be wrong, but all of which ultimately point to the right answer. Now Keynes, in 'The General Theory of Employment, Interest and Money,' set forth a hypothesis which was a beautiful one, and it really altered the shape of economics. But it turned out that it was a wrong hypothesis. That doesn't mean that he wasn't a great man!

There's basically an element of fiction in everything you remember. Imagination and memory are almost the same brain processes. When I write fiction, I know that I'm using a bunch of lies that I've made up to create some form of truth. When I write a memoir, I'm using true elements to create something that will always be somehow fictionalized.

As soon as science has emerged from its initial stages, theoretical advances are no longer achieved merely by a process of arrangement. Guided by empirical data, the investigator rather develops a system of thought which, in general, is built up logically from a small number of fundamental assumptions, the so-called axioms. We call such a system of thought a theory. The theory finds the justification for its existence in the fact that it correlates a large number of single observations, and it is just here that the 'truth' of the theory lies.

What's the best gamble in the world, right now? Its betting that Deutsche Bank stock is going to go down. Short sellers borrowed money from their banks to place bets that Deutsche Bank stock is going to go down. Now, it's wringing its hands and saying, "Oh the speculators are killing us." But it's Deutsche Bank and the other banks that are providing the money to the speculators to bet on credit.

Unfortunately, our stock is somehow not well understood by the markets. The market compares us with generic companies. We need to look at Biocon as a bellwether stock. A stock that is differentiated, a stock that is focused on R&D, and a very, very strong balance sheet with huge value drivers at the end of it.

Unfortunately our stock is somehow not well understood by the markets. The market compares us with generic companies. We need to look at Biocon as a bellwether stock. A stock that is differentiated, a stock that is focused on R&D, and a very-very strong balance sheet with huge value drivers at the end of it.

Must love be ever treated with profaneness as a mere illusion? or with coarseness as a mere impulse? or with fear as a mere disease? or with shame as a mere weakness? or with levity as a mere accident? whereas it is a great mystery and a great necessity, lying at the foundation of human existence, morality, and happiness,--mysterious, universal, inevitable as death.

But even in the absence of direct interference by those who had the power to interfere, the process was usually aborted by the non-availability of one of more elements of the process - the accumulated stock in a money form, the labor-power to be utilized by the producer, the network of distributors, the consumers who were purchasers. One or more elements were missing because, in previous historical social systems, one or more of these elements was not commodified or was insufficiently commodified.