A Quote by Joseph Stiglitz

These debt obligations will simply erode America's standard of living in the future. Money spent to service the debt is money that we don't have to spend on consumption's goods, or on investment in our future.

Quote Topics

Related Quotes

So we are in for years of debt deflation. That means that people have to pay so much debt service for mortgages, credit cards, student loans, bank loans and other obligations

that they have less to spend on goods and services. So markets shrink. New investment and employment fall off, and the economy is falls into a downward spiral.

In a speech at the just-concluded G20 summit in London, President Obama urged Americans not to let their fears crimp their spending. It would be unwise, he argued, for Americans to let the fear of job loss, lack of savings, unpaid bills, credit card debt or student loans deter them from making major purchases. According to the president, 'we must spend now as an investment for the future'....instead of saving for the future, we must spend for the future.

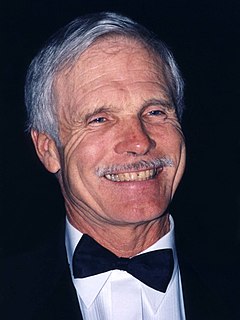

I made a lot of money. I earned a lot of money with CNN and satellite and cable television. And you can't really spend large sums of money, intelligently, on buying things. So I thought the best thing I could do was put some of that money back to work - making an investment in the future of humanity.

...our societies appear to be intent on immediate consumption rather than on investment for the future. We are piling up enormous debts and exploiting the natural environment in a manner which suggests that we have no real sense of any worthwhile future. Just as a society which believes in the future saves in the present in order to invest in the future, so a society without belief spends everything now and piles up debts for future generations to settle. "Spend now and someone else will pay later."

There's also consumer debt, the credit card debt that burdens many of the working families in America. Yes, we talk about national debt, and we're paying a lot down. But you're fixing to hear me tell you part of the remedy for people who have got a lot of credit card debt is to make sure people get some of their own money back.

Avoid debt that doesn’t pay you. Make it a rule that you never use debt that won’t make you money. I borrowed money for a car only because I knew it could increase my income. Rich people use debt to leverage investments and grow cash flows. Poor people use debt to buy things that make rich people richer.