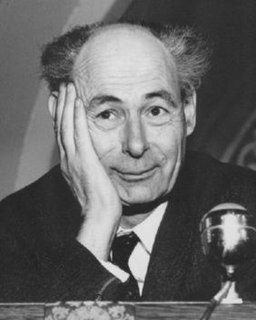

A Quote by John C. Bogle

Working for company X and having a substantial portion of your retirement plan in company X is simply exposing yourself to too much risk, because the company is both your employer and the source of your retirement income. So if something goes wrong, you lose both your job and your retirement plan.

Related Quotes

People look at things differently. Imagine going to a village in Southern Sudan and try to explain to someone there the concept of life insurance or retirement. Go to Vietnam and say retirement. Retirement in another country is your body is too racked with pain and your hands are too arthritic from the life in the rice patty fields, so you can't work anymore. So you move in with your son and his new wife takes care of you because that's how families work there.

Use visual cues to prompt yourself to put away more. A photograph of the beach house where you and your husband can envision spending your retirement will remind you to bump up the contribution to your 401(k); a snapshot of your child in a college sweatshirt can encourage you to put more into a 529 college savings plan.

The risk of working with people you don't respect; the risk of working for a company whose values are incosistent with your own; the risk of compromising what's important; the risk of doing something that fails to express-or even contradicts--who you are. And then there is the most dangerous risk of all--the risk of spending your life not doing what you want on the bet that you can buy yourself the freedom to do it later.