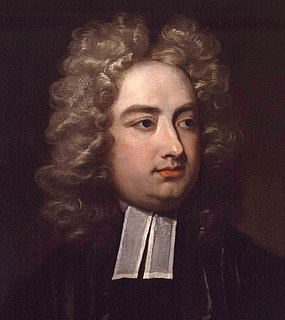

A Quote by Jonathan Swift

Censure is the tax a man pays to the public for being eminent.

Related Quotes

The IRS spends God knows how much of your tax money on these toll-free information hot lines staffed by IRS employees, whose idea of a dynamite tax tip is that you should print neatly. If you ask them a real tax question, such as how you can cheat, they're useless. So, for guidance, you want to look to big business. Big business never pays a nickel in taxes, according to Ralph Nader, who represents a big consumer organization that never pays a nickel in taxes. . . .

It makes no difference to a widow with her savings in a 5 percent passbook account whether she pays 100 percent income tax on her interest income during a period of zero inflation or pays no income tax during years of 5 percent inflation. Either way, she is 'taxed' in a manner that leaves her no real income whatsoever. Any money she spends comes right out of capital. She would find outrageous a 100 percent income tax but doesn't seem to notice that 5 percent inflation is the economic equivalent.

The stage I chose--a subject fair and free--

'Tis yours--'tis mine--'tis public property.

All common exhibitions open lie,

For praise or censure, to the common eye.

Hence are a thousand hackney writers fed;

Hence monthly critics earn their daily bread.

This is a general tax which all must pay,

From those who scribble, down to those who play.