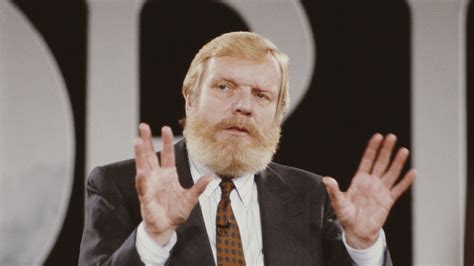

A Quote by Dominic Grieve

Trade wars in which countries are then obliged to retaliate by raising their own tariffs against the initiator undermine growth and hurt consumers. Far from being expressions of strength they highlight the failure of the initiating country's economic sector to compete in the global market place.

Related Quotes

The economic borderlines of our world will not be drawn between countries, but around Economic Domains. Along the twin paths of globalization and decentralization, the economic pieces of the future are being assembled in a new way. Not what is produced by a country or in a country will be of importance, but the production within global Economic Domains, measured as Gross Domain Products. The global market demands a global sharing of talent. The consequence is Mass Customization of Talent and education as the number one economic priority for all countries

Tariffs are in the end taxes. And somebody has to pay that tax. I think one thing people are forgetting is that trade disputes are two-sided. When the United States imposes tariffs on a partner like Canada, there is always a possibility that Canada will say that's not fair and retaliate. And at that point, you have to ask the question, - which U.S. industry will suffer because the Canadians retaliated against it?

If China stood on an equal basis with other nations, she could compete freely with them in the economic field and be able to hold her own without failure. But as soon as foreign nations use political power as a shield for their economic designs, then China is at a loss how to resist or to compete successfully with them.

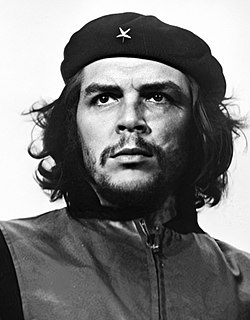

The inflow of capital from the developed countries is the prerequisite for the establishment of economic dependence. This inflow takes various forms: loans granted on onerous terms; investments that place a given country in the power of the investors; almost total technological subordination of the dependent country to the developed country; control of a country's foreign trade by the big international monopolies; and in extreme cases, the use of force as an economic weapon in support of the other forms of exploitation.

[Barack] Obama, for example, he has not given up on cap-and-trade. Now, he has not been able to pass cap-and-trade, but cap-and-trade is all about redistribution of wealth in a global basis - taking money out of this country and giving it to third-world countries on the other end of the ocean. And that is redistribution of wealth in a global basis. It's fundamental Marxism.