A Quote by David Wessel

I think the Chinese are really amateurs when it comes to running markets.

Related Quotes

Turning pro is a mindset. If we are struggling with fear, self-sabotage, procrastination, self-doubt, etc., the problem is, we're thinking like amateurs. Amateurs don't show up. Amateurs crap out. Amateurs let adversity defeat them. The pro thinks differently. He shows up, he does his work, he keeps on truckin', no matter what.

Turning pro is a mindset. If we are struggling with fear, self-sabotage, procrastination, self-doubt, etc., the problem is, we’re thinking like amateurs. Amateurs don’t show up. Amateurs crap out. Amateurs let adversity defeat them. The pro thinks differently. He shows up, he does his work, he keeps on truckin’, no matter what.

Marathon running, like golf, is a game for players, not winners. That is why Callaway sells golf clubs and Nike sells running shoes. But running is unique in that the world's best racers are on the same course, at the same time, as amateurs, who have as much chance of winning as your average weekend warrior would scoring a touchdown in the NFL.

I think people are complacent. But complacency is like any other metric. It's easy to measure where it is, but it's hard to tell how persistent it is. What causes really big bear markets is not just when people are overly complacent - it's when that complacency is sticky. As long as the skepticism can refresh itself, I think that the markets are still quite viable.

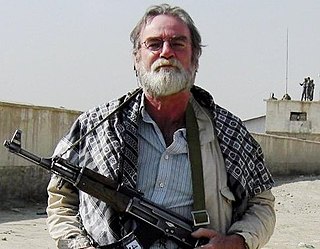

There are photographers who push for war because they make stories. They search for a Chinese who has a more Chinese are than the others and they end up finding one. They have him take a typically Chinese pose and surround him with chinoiseries. What have they captured on their film? A Chinese? Definitely not: the idea of the Chinese.