A Quote by David Graeber

If you look at history, there seems to be a regular pattern: the country with the most powerful military also happens to be the one with the world trade currency. That gives them an enormous economic advantage, which causes goods to flow into their country.

Related Quotes

The defining moment in American economic history is when Bill Clinton lobbied to get China into the World Trade Organization. It was the worst political and economic mistake in American history in the last 100 years. China went into the World Trade Organization and agreed to play by certain rules. Instead, they are illegally subsidizing their exports, manipulating their currency, stealing all of our intellectual property, using sweatshops, using pollution havens. What happens is, our businesses and workers are playing that game with two hands tied behind their back.

There are three important principles to Graham's approach. [The first is to look at stocks as fractional shares of a business, which] gives you an entirely different view than most people who are in the market. [The second principle is the margin-of-safety concept, which] gives you the competitive advantage. [The third is having a true investor's attitude toward the stock market, which] if you have that attitude, you start out ahead of 99 percent of all the people who are operating in the stock market - it's an enormous advantage.

Our country is in serious trouble. We don't win anymore.We don't beat China in trade. We don't beat Japan, with their millions and millions of cars coming into this country, in trade. We can't beat Mexico, at the border or in trade.We can't do anything right. Our military has to be strengthened. Our vets have to be taken care of. We have to end Obamacare, and we have to make our country great again, and I will do that.

In a modern digitalized world, it is possible to paralyze a country without attacking its defense forces: The country can be ruined by simply bringing its SCADA systems to a halt. To impoverish a country, one can erase its banking records. The most sophisticated military technology can be rendered irrelevant. In cyberspace, no country is an island.

If the American government can't stand behind the dollar, the world's benchmark currency, then the global financial system will very likely enter a new era in which there is much less trade and much less economic growth. It would be, by most accounts, the largest self-imposed financial disaster in history.

I hold all idea of regulating the currency to be an absurdity; the very terms of regulating the currency and managing the currency I look upon to be an absurdity; the currency should regulate itself; it must be regulated by the trade and commerce of the world; I would neither allow the Bank of England nor any private banks to have what is called the management of the currency.

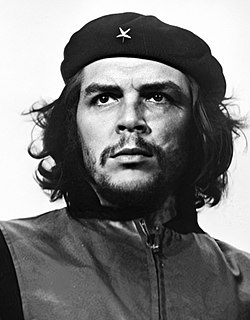

The inflow of capital from the developed countries is the prerequisite for the establishment of economic dependence. This inflow takes various forms: loans granted on onerous terms; investments that place a given country in the power of the investors; almost total technological subordination of the dependent country to the developed country; control of a country's foreign trade by the big international monopolies; and in extreme cases, the use of force as an economic weapon in support of the other forms of exploitation.