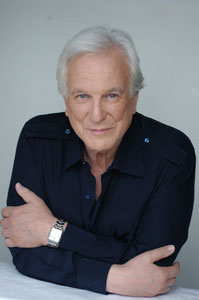

A Quote by David Cameron

The world economy is more stable than for a generation ... Our hugely sophisticated financial markets match funds with ideas better than ever before.

Related Quotes

In a world in which we are exposed to more information, more options, more philosophies, more perspectives than ever before, in which we must choose the values by which we will live (rather than unquestioningly follow some tradition for no better reason than that our own parents did), we need to be willing to stand on our own judgment and trust our own intelligence-to look at the world through our own eyes-to chart our course and think through how to achieve the future we want, to commit ourselves to continuous questioning and learning-to be, in a word, self-responsible.

In the past six months, our federal government has devised a dozen strategies to save America's financial markets. Each plan has been more costly, more risky, and less aligned with the principles of our country's free market economy than the last. I am disappointed to say that this latest plan puts all the rest of them to shame.

There is a connection waiting to be made between the decline in democratic participation and the explosion in new ways of communicating. We need not accept the paradox that gives us more ways than ever to speak, and leaves the public with a wider feeling than ever before that their voices are not being heard. The new technologies can strengthen our democracy, by giving us greater opportunities than ever before for better transparency and a more responsive relationship between government and electors

The most serious problems lie in the financial sphere, where the economy's debt overhead has grown more rapidly than the 'real' economy's ability to carry this debt. [...] The essence of the global financial bubble is that savings are diverted to inflate the stock market, bond market and real estate prices rather than to build new factories and employ more labor.

Other than our disagreement over Syria, I would say our relationship with Russia is very good and we are seeking to broaden and deepen it. Twenty million Russians are Muslims. Like Russia, we have an interest in fighting radicalism and extremism. We both have an interest in stable energy markets. Even the disagreement over Syria is more of a tactical one than a strategic one. We both want a unified Syria that is stable in which all Syrians enjoy equal rights.

Nothing highlights better the continuing gap between rhetoric and substance in British financial services than the failure of providers here to emulate Jack Bogle's index fund success in the United States. Every professional in the City knows that index funds should be core building blocks in any long-term investor's portfolio. Since 1976, the Vanguard index funds has produced a compound annual return of 12 percent, better than three-quarters of its peer group.

We are more connected than ever before, more able to spread our ideas and beliefs, our anger and fears. As we exercise the right to advocate our views, and as we animate our supporters, we must all assume responsibility for our words and actions before they enter a vast echo chamber and reach those both serious and delirious, connected and unhinged.