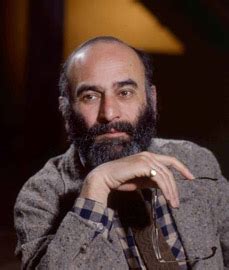

A Quote by David Malpass

The Fed should make a clear commitment to stable money to reduce the swings in interest rates and inflation. Instead, it champions and flaunts unstable money. This encourages momentum trading and the growth of derivatives. Meanwhile, layers of financial regulation make Washington bigger and more powerful but don't fix the underlying problems.

Quote Topics

Bigger

Champions

Clear

Commitment

Derivatives

Encourages

Fed

Financial

Financial Regulation

Fix

Growth

Inflation

Instead

Interest

Interest Rate

Interest Rates

Layers

Make

Meanwhile

Momentum

Money

More

More Power

Powerful

Problems

Rates

Reduce

Regulation

Should

Stable

Swings

Trading

Underlying

Unstable

Washington

Related Quotes

The Fed should make a clear commitment to stable money to reduce the swings in interest rates and inflation. Instead, it champions and flaunts unstable money. This encourages momentum trading and the growth of derivatives. Meanwhile, layers of financial regulation make Washington bigger and more powerful but dont fix the underlying problems.

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output... A steady rate of monetary growth at a moderate level can provide a framework under which a country can have little inflation and much growth. It will not produce perfect stability; it will not produce heaven on earth; but it can make an important contribution to a stable economic society.

The time will come, and probably during 2009, that the only way the U.S. will be able to fund its deficits is to create money by printing it. The Treasury will have to sell bonds, and, in the absence of foreign buyers, the Fed will have to print the money to buy them. The consequence will be runaway inflation, increasing interest rates, recession, and inevitable tax increases on all Americans.

Significant changes in the growth rate of money supply, even small ones, impact the financial markets first. Then, they impact changes in the real economy, usually in six to nine months, but in a range of three to 18 months. Usually in about two years in the US, they correlate with changes in the rate of inflation or deflation."

"The leads are long and variable, though the more inflation a society has experienced, history shows, the shorter the time lead will be between a change in money supply growth and the subsequent change in inflation.

To walk in money through the night crowd, protected by money, lulled by money, dulled by money, the crowd itself a money, the breath money, no least single object anywhere that is not money. Money, money everywhere and still not enough! And then no money, or a little money, or less money, or more money but money always money. and if you have money, or you don't have money, it is the money that counts, and money makes money, but what makes money make money?

We live in a global market and money's fungible and hedge fund private equity is looking for momentum plays, and there ain't no momentum plays in bonds, right? When the interest rates were spiking up or down, well they never really spike down they do spike up though. Something's got to happen, there's got to be motion, the dice has to be rolling on the board, and if it's not then they're not going to play because they're not going to get the adrenaline rush from looking at... you know, money markets fund interest rates or bond interests or whatever. It's got to be sexy.

People will make worse financial decisions for them if they're choosing from a lot of options than if they're choosing from a few options. If they have more options they're more likely to avoid stocks and put all their money in money market accounts, which doesn't even grow at the rate of inflation.

The reality is the most important thing that can be done are these permanent changes like to the tax code, reduction of government spending. These are the things that pop up in economy and move it in the right direction, start to make it an economy that is moving because of the money in the private economy. When you think about it, when the Fed is lowering an interest rate, what it's doing is it's creating more liquidity. It's putting more money into the economy. The same thing happens when you reduce the tax except if happens from physical policy.

The Fed has one power that is unique to it alone: it enables the creation of money out of thin air. Sometimes it makes vast new amounts. Sometimes it makes lesser amounts. The money takes a variety of forms and enters the system in various ways. And the Fed does this through techniques such as open-market operations, changing reserve ratios, and manipulating interest rates, operations that all result in money creation.