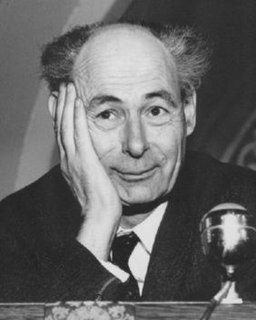

A Quote by Jean Chatzky

Your retirement comes before your children's tuition. That's because there's no financial aid for retirement, and there's still a good deal available for college.

Related Quotes

People look at things differently. Imagine going to a village in Southern Sudan and try to explain to someone there the concept of life insurance or retirement. Go to Vietnam and say retirement. Retirement in another country is your body is too racked with pain and your hands are too arthritic from the life in the rice patty fields, so you can't work anymore. So you move in with your son and his new wife takes care of you because that's how families work there.

No one anticipates divorce when they're exchanging vows, and it can be devastating emotionally and financially. To ease the financial side of the blow, you need to maintain your financial identity in your relationship. That means having your own credit history - you need your own credit card - and your own savings and retirement accounts.

Financial literacy is not an end in itself, but a step-by-step process. It begins in childhood and continues throughout a person's life all the way to retirement. Instilling the financial-literacy message in children is especially important, because they will carry it for the rest of their lives. The results of the survey are very encouraging, and we want to do our part to make sure all children develop and strengthen their financial-literacy skills.

Use visual cues to prompt yourself to put away more. A photograph of the beach house where you and your husband can envision spending your retirement will remind you to bump up the contribution to your 401(k); a snapshot of your child in a college sweatshirt can encourage you to put more into a 529 college savings plan.

Social Security is fine for those at or near retirement today. For those receiving their checks today, don't worry. It's going to be there for you. For those that are nearing their retirement years, don't worry, it's going to be there for you. But for your kids - for your boy and my boy, and for their children, for our kids and grandkids, it's a real big question as to whether or not the system's going to be there.

Absolutely invest in retirement. You can always get a loan to get kids through school. I do not know of any loans to get you through retirement. The markets are seriously low from where they were (even though they've gone up 30 percent recently). Now is the time to be dollar cost averaging; the more money you put in, the more shares you buy. Save for your retirement, people.