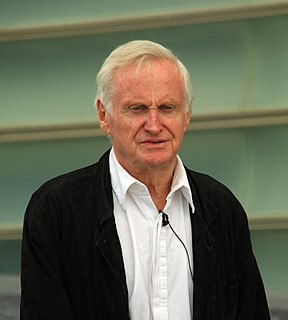

A Quote by Vince Cable

I think what is happening is I think first of all there is confidence in the U.K. economy. We're in a German rather than a Greek position in international financial markets, which is very positive and keeps our debt service costs down, and we're also beginning to see real evidence of rebalancing.

Related Quotes

The most serious problems lie in the financial sphere, where the economy's debt overhead has grown more rapidly than the 'real' economy's ability to carry this debt. [...] The essence of the global financial bubble is that savings are diverted to inflate the stock market, bond market and real estate prices rather than to build new factories and employ more labor.

To restore confidence in our markets and our financial institutions so they can fuel continued growth and prosperity, we must address the underlying problem. The federal government must implement a program to remove these illiquid assets that are weighing down our financial institutions and threatening our economy.

Concerning our possibilities on the international financial markets, the sanctions are severely harming Russia. But the biggest harm is currently caused by the decline of the prices for energy. We suffer dangerous revenue losses in our export of oil and gas, which we can partly compensate for elsewhere. But the whole thing also has a positive side: if you earn so many petrodollars - as we once did - that you can buy anything abroad, this slows down developments in your own country.

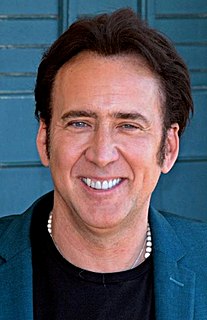

All the interesting films are now being made by their subsidiaries for very low budgets. But the studios are not making money. They're making these big, very expensive pictures that take a lot of money but don't really pay for their costs. So they're having a very difficult time. I can see the system breaking down. I think the American studios are a reflection or a metaphor for American industry altogether, which is failing in the world. Its economic domination is being broken down and I think the same thing is happening to the studios.

I think that even though The German Doctor (Wakolda) is placed in a historical context , it is a very intimate story. The film has been extremely well received around the world. It keeps on going around, opening in different markets, and connecting with the audience. In Argentina it was seen by over 450, 000 spectators, which is way more than anything we could have imagined.

In certain circumstances, financial markets can affect the so-called fundamentals which they are supposed to reflect. When that happens, markets enter into a state of dynamic disequilibrium and behave quite differently from what would be considered normal by the theory of efficient markets. Such boom/bust sequences do not arise very often, but when they do, they can be very disruptive, exactly because they affect the fundamentals of the economy.

If Americans are frustrated with Congress, imagine their frustration with a group of international bank officials running our ecomomy-bankers who may not have as their motive either to see us out of debt to them or to strengthen our economy, society, international influence, or other elements of our way of life.

I think that movies can help guide us through those experiences [the problems that are happening in our daily lives, the stresses between countries, the economy and global warming]. I think all art tries to grapple with, redefine, come to terms with, express what's happening now when it's working. You can be entertained, but you can also be stimulated to think about things.