A Quote by Christiane Amanpour

Our industry has invested so much money in technology that perhaps it's time to invest in talent, in people.

Related Quotes

Every peasant cuisine has incredible ingenious tricks for getting a lot of nutrition out of a small amount of ingredients. There are people who don't have the money to invest in better food, but perhaps they have the time. There's a trade-off: The more time you're willing to put into food preparation, the less money you have to spend.

Probably the greatest single obstacle to the progress and happiness of the American people lies in the willingness of so many men to invest their time and money in multiplying competitive industries instead of opening up new fields, and putting their money into lines of industry and development that are needed.

With our technology, with objects, literally three people in a garage can blow away what 200 people at Microsoft can do. Literally can blow it away. Corporate America has a need that is so huge and can save them so much money, or make them so much money, or cost them so much money if they miss it, that they are going to fuel the object revolution.

There's so much impetus for change, there's so much desire to not have this oil economy continue, but it continues nonetheless. And people often assume that's because technology is not good enough, or there's no money being invested, or it's just not ready yet. It's none of that. It's actually a system of government and corporate behavior that work in collusion and lock step with one another to deflect any momentum toward true alternative energies.

The biggest challenge is that when people look at low price point products, they essentially invest less money in development, innovation, and new technology. And in order to innovate at a lower price point, and make sustainability attainable to the masses, you have to invest more. But that's counterintuitive for a lot of businesses.

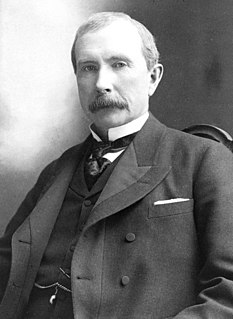

Many people don't have the ability to be rich, because they're too lazy or they don't have the desire or the stick-to-itiveness. It's a talent. Some people have a talent for piano. Some people have a talent for raising a family. Some people have a talent for golf. I just happen to have a talent for making money.