A Quote by Christine Lagarde

As far as Athens is concerned, I also think about all those people who are trying to escape tax all the time. All these people in Greece who are trying to escape tax.

Related Quotes

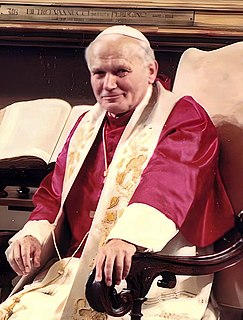

Faced with today's problems and disappointments , many people will try to escape from their responsibility. Escape in selfishness, escape in sexual pleasure, escape in drugs, escape in violence, escape in indifference and cynical attitudes. I propose to you the option of love, which is the opposite of escape.

Who are we talking about? We're talking about the people that are trying to criminalize Donald Trump. We're talking about the people that are trying to impeach him. We're talking about people who are trying to via innuendo and leak and media assassination, we're dealing with people that are trying to destroy Donald Trump and his press secretary just signaled that they are serious about reaching out to these people to try to get certain things done, legislatively, like infrastructure or tax reform.

We were giving advice for the single-worst idea to come forward from a group that's been rife with them, it would be this: The idea is this: Let's make the tax code of America better for very rich people; let's give substantial tax relief to the richest people we can find. Forget about the person making $40,000 a year and paying Social Security payroll tax. Forget about all those other people paying income tax; we're here to give tax relief to the richest 2% of America.