A Quote by Li Lu

The financial crisis of 2008-09 was in large part the result of the so-called 'success' of people who did not understand their fiduciary duty. This kind of 'success' is extremely harmful to all of society.

Related Quotes

Let's stop for a second and remember where we were eight years ago [in 2008]. We had the worst financial crisis, the Great Recession, the worst since the 1930s. That was in large part because of tax policies that slashed taxes on the wealthy, failed to invest in the middle class, took their eyes off of Wall Street, and created a perfect storm.

Now, success is not the result of making money; making money is the result of success - and success is in direct proportion to our service. Most people have this law backwards. They believe that you're successful if you earn a lot of money. The truth is that you can only earn money after you're successful.

The goals you set for yourself and the strategies you choose become your blueprint or plan. Strategies are like recipes: choose the right ingredients, mix them in the correct proportions, and you will always produce the same predictable results: in this case financial success. The success strategies for managing money and building wealth are called Money Strategies. By learning to use money strategies as a part of your day-to-day life, financial frustration and failure will become a thing of the past.

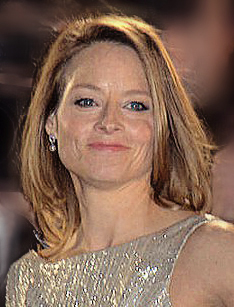

I think our culture views success as visibility, being seen as being successful. Whereas I've learned that success is rooted in helping and connecting to other people, and knowing where you can contribute. I've kind of spent my thirties doing that, because in my twenties I was seeking any kind of success.

It is no exaggeration to say that since the 1980s, much of the global financial sector has become criminalised, creating an industry culture that tolerates or even encourages systematic fraud. The behaviour that caused the mortgage bubble and financial crisis of 2008 was a natural outcome and continuation of this pattern, rather than some kind of economic accident.