A Quote by Luke Rockhold

I've had to take out a couple of loans; I'm not gonna lie. I want to pay off my debts. I want to start stacking some cash and set myself up for the future.

Related Quotes

If you have loans, the first thing you want to do is say, "Okay, look I have a credit card, if I really need to borrow, I have this emergency money that I can get, but for now there is no reason for me to keep cash at zero percent interest rate and at the same time, pay all of this money out. So, I think people need to figure out quickly how to pay loans and how much cash they should really keep.

There is something wrong with our system when I can leave here and make billions of dollars in 10 years while millions of students can't even afford to pay off their loans, let alone start a business. We all know you don't get successful just by having a good idea or working hard. You get successful by being lucky too. If I had to support my family growing up, instead of having the time to learn how to code. If I didn't know that I was gonna be fine if Facebook didn't work out, then I wouldn't be standing up here today. And if we're honest, we all know how much luck we've had.

...our societies appear to be intent on immediate consumption rather than on investment for the future. We are piling up enormous debts and exploiting the natural environment in a manner which suggests that we have no real sense of any worthwhile future. Just as a society which believes in the future saves in the present in order to invest in the future, so a society without belief spends everything now and piles up debts for future generations to settle. "Spend now and someone else will pay later."

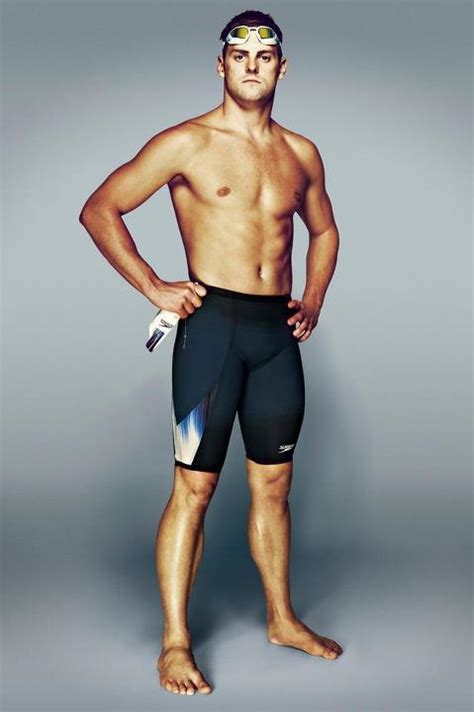

I set goals, but they're mostly very personal goals. I never try and set a goal where 'I want to win this,' or 'I want to do this,' where other people can affect what I do. If I want to swim a new best time, I sit down and work out the best way of doing that. Whether I can shave a few tenths of a second off a turn or the start, my goal is putting them all together in a race. That's the way I set my goals.

Imagine you have six loans, small to huge. People want to close loans and because of that, they try to pay off the small loans, but that's not the right strategy. The right strategy, of course, is to pay the loan with the highest interest rate. People make this mistake and it costs them lots and lots of money, it's a very expensive mistake because interest rates accumulate and become very, very expensive very quickly.

There are two definitions of deflation. Most people think of it simply as prices going down. But debt deflation is what happens when people have to spend more and more of their income to carry the debts that they've run up - to pay their mortgage debt, to pay the credit card debt, to pay student loans.