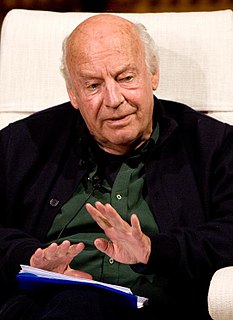

A Quote by Michael Hudson

Inflation usually helps the economy at large, but not the 1% if wages rise. So the 1% says that it is terrible.

Related Quotes

There is no such thing as agflation. Rising commodity prices, or increases in any prices, do not cause inflation. Inflation is what causes prices to rise. Of course, in market economies, prices for individual goods and services rise and fall based on changes in supply and demand, but it is only through inflation that prices rise in aggregate.

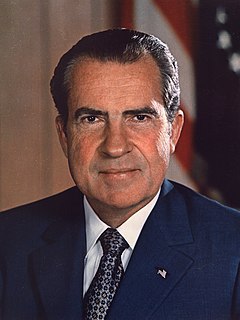

Democrats in Washington predicted that tax cuts would not create jobs, would not increase wages, and would cause the federal deficit to explode. Well, the facts are in. The tax cuts have led to a strong economy. Real wages were on the rise, and deficit has been cut in half three years ahead of schedule.

Sharp increases in the minimum wage rate are also inflationary. Frequently workers paid more than the minimum gauge their wages relative to it. This is especially true of those workers who are paid by the hour. An increase in the minimum therefore increases their demands for higher wages in order to maintain their place in the structure of wages. And when the increase is as sharp as it is in H.R. 7935, the result is sure to be a fresh surge of inflation.