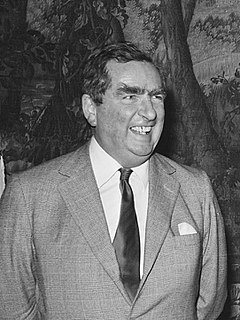

A Quote by Mario Monti

The two greatest priorities for my government are tackling tax evasion and corruption.

Quote Topics

Related Quotes

Full statehood in Delhi is a larger issue as compared to anti-corruption. For, only when the Delhi government gets its anti-corruption bureau back will it get the power of suspension and vigilance inquiries on corrupt officers of different departments of the government. That is how you can curb the corruption.

The tax that was supposed to soak the rich has instead soaked America. The beneficiary of the income tax has not been the poor, but big government. The income tax has given us a government bureaucracy that outnumbers the manufacturing work force. It has created welfare dependencies that have entrapped millions of Americans in an underclass that is forced to live a sordid existence of trading votes for government handouts.

[The taxing power of the state] divides the community into two great classes: one consisting of those who, in reality, pay the taxes and, of course, bear exclusively the burden of supporting the government; and the other, of those who are the recipients of their proceeds through disbursements,and who are, in fact, supported by the government; or, in fewer words, to divide it into tax-payers and tax-consumers. But the effect of this is to place them in antagonistic relations in reference to the fiscal action of the government and the entire course of policy therewith connected.