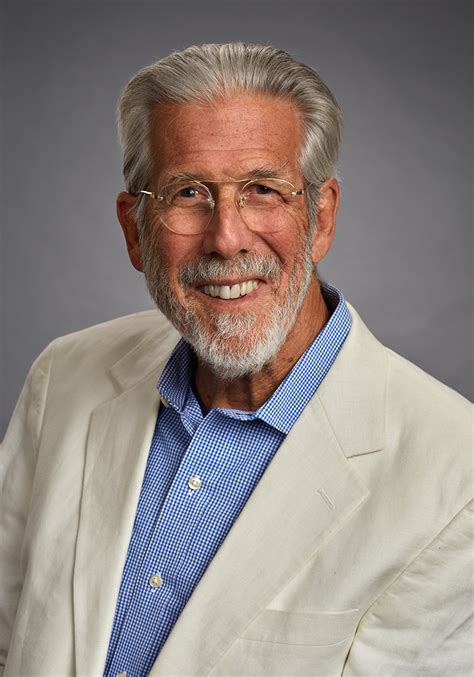

A Quote by Mark Skousen

Remember, gold and silver always have had value and never have gone to zero. Can you say the same for stocks and bonds?

Related Quotes

For all your long-term investments, such as retirement accounts that you won't touch for at least ten years, you need a mix of stocks and bonds. Stocks offer the best shot at inflation-beating gains. But stocks don't always go up. That's where bonds come into play: They have less upside potential, but they also do not pack the same risk.

Back in 1960, the paper dollar and the silver dollar both were the same value. They circulated next to each other. Today? The paper dollar has lost 95% of its value, while the silver dollar is worth $34, and produced a 2-3 times rise in real value. Since we left the gold standard in 1971, both gold and silver have become superior inflation hedges.

If anybody has any idea of hoarding our silver coins, let me say this. Treasury has a lot of silver on hand, and it can be, and it will be used to keep the price of silver in line with its value in our present silver coin. There will be no profit in holding them out of circulation for the value of their silver content.

When I was on tour, people would say "We don't need a value-based currency, we can go out and buy gold and silver with US dollars now." I mean that it is so utterly brain dead, because they miss the whole point: the reason we need to have a gold and silver based currency is to bring discipline to the financial system so the government can't go out and do all sorts of bad things.

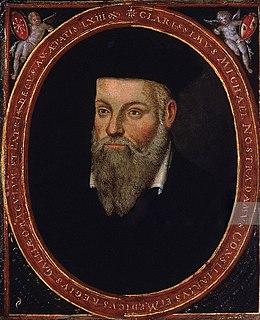

The inflated imitations of gold and silver, which after the rapture are thrown into the fire, all is exhausted and dissipated by the debt. All scrips and bonds are wiped out. At the fourth pillar dedicated to Saturn, split by earthquake and flood: vexing everyone, an urn of gold is found and then restored.

Gold has intrinsic value. The problem with the dollar is it has no intrinsic value. And if the Federal Reserve is going to spend trillions of them to buy up all these bad mortgages and all other kinds of bad debt, the dollar is going to lose all of its value. Gold will store its value, and you'll always be able to buy more food with your gold.

It is an unfortunate fact that great and foolish excess can come into prices of common stocks in the aggregate. They are valued partly like bonds, based on roughly rational projections of use value in producing future cash. But they are also valued partly like Rembrandt paintings, purchased mostly because their prices have gone up, so far.