A Quote by Michele Bachmann

I'm not only a lawyer, I have a post doctorate degree in federal tax law from William and Mary. I work in serious scholarship and work in the United States federal tax court. My husband and I raised five kids. We've raised 23 foster children. We've applied ourselves to education reform. We started a charter school for at-risk kids.

Related Quotes

In 2013 Citigroup had profits of $6.4 billion in the United States. They paid no federal income tax and, in fact, received a rebate from the IRS of $260 million. That same year J.P. Morgan had $17.2 billion in profits in the U.S. They also paid no federal income tax. Do you think it's time for tax reform?

I took office as president in January 2003, and in April 2003, I sent to Congress my first proposal for tax reform. Some parts were voted on, with respect to federal taxes, and then it came to a standstill. Why? Because each state is interested in its own tax reform, has its own tax policy, and each state has its federal deputies and senators.

When two working people decide to marry, their federal income tax is usually increased. As soon as one spouse earns at least 20 percent of a married couple's total income, the couple pays a 'marriage tax.' ... The United States is the only major industrialized nation in the free world in which the tax cost of the second [married] earner's entry into the work force is higher than that of the first. On one hand, our government's social policy is to help working women earn equal salaries to those of men, but on the other we have a tax structure that penalizes them when they do so.

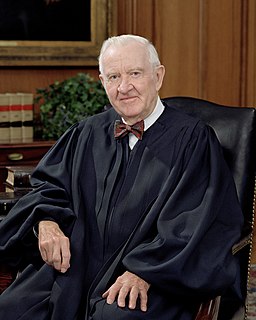

When I joined the Supreme Court in 1975, both state and federal judges accepted the Court's unanimous decision in United States v. Miller as having established that the Second Amendment's protection of the right to bear arms was possessed only by members of the militia and applied only to weapons used by the militia.

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.