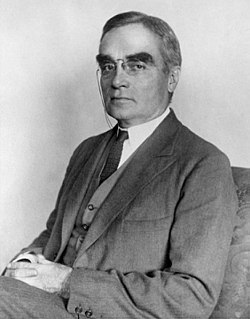

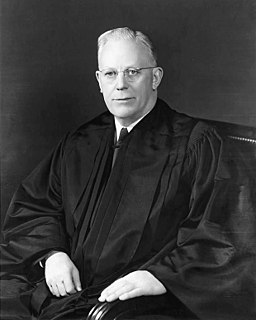

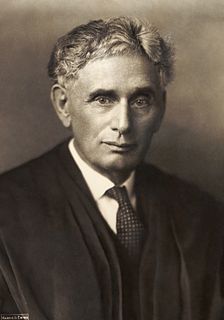

A Quote by Learned Hand

In america, there are two tax systems: one for the informed and one for the uninformed. Both are legal

Quote Topics

Related Quotes

There's such a wide variation in tax systems around the world, it's difficult to imagine a harmonized CO2 tax that every country agrees to. That's not in the cards in the near term. But the countries that are doing the best job, like Sweden, are already doing both of these. I think that eventually we'll use both of them but we need to get started right away and the cap-and-trade is a proven and effective tool.

There are two kinds of systems in the world. There are many-party systems and there are two-party systems. And our English cousins, both England, Canada, Australia, India, tend to have majority rule elections, rather than proportional elections and that tends to lead them to have two sort of competing parties. So in England, you know, it's been, you know, since the '20's, that anybody other than Labor or the Conservatives have formed a government and gotten a Prime Minister in the Cabinet, and so on.

I'll give you a simple formula for straightening out the problems of the United States. First, you tax the churches. You take the tax off of capital gains and the tax off of savings. You decriminalize all and tax them same way as you do alcohol. You decriminalize . You make gambling legal. That will put the budget back on the road to recovery, and you'll have plenty of tax revenue coming in for all of your social programs, and to run the army.

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

The poverty we see in America is now too widespread, and too complex, for easy fixes. But I do think we can reimagine many of our institutions and can create new ones in ways that would be effective. We could, for example, create social insurance systems, similar to social security, such as that we went through in 2008-9. We could create a financial transaction tax, oil profit taxes and a fairer estate tax system, and we could plow much of the revenue raised from these into job training programs, into better education infrastructure, into an expanded Earned Income Tax Credit.

I appreciate the good work that senators in both parties have put into trying to fix our broken immigration system. There are some good elements in this proposal, especially increasing the resources and manpower to secure our border and also improving and streamlining legal immigration. However, I have deep concerns with the proposed path to citizenship. To allow those who came here illegally to be placed on such a path is both inconsistent with rule of law and profoundly unfair to the millions of legal immigrants who waited years, if not decades, to come to America legally.

We were giving advice for the single-worst idea to come forward from a group that's been rife with them, it would be this: The idea is this: Let's make the tax code of America better for very rich people; let's give substantial tax relief to the richest people we can find. Forget about the person making $40,000 a year and paying Social Security payroll tax. Forget about all those other people paying income tax; we're here to give tax relief to the richest 2% of America.