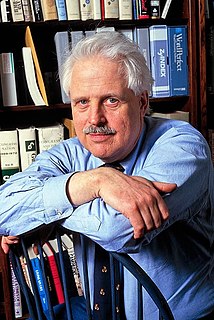

A Quote by Nicholas von Hoffman

We preach free enterprise capitalism. We believe in it, we give our lives in war for it, but the closest most of us come to profiting from it are a few miserable shares of stock in a company that doesn't pay large enough dividends to keep a small mouse in cheese. The truth is, most of us are job serfs. At a time when invested capital returns 20 to 30 percent, we have no capital. We only have our wages and salaries, and a debt so high that something like 20c on every dollar we earn is spent to pay off what we owe.

Quote Topics

Believe

Capital

Capitalism

Cheese

Closest

Come

Company

Debt

Dividends

Dollar

Earn

Enough

Enterprise

Every

Few

Free

Free Enterprise

Give

High

Invested

Job

Keep

Large

Like

Lives

Miserable

Most

Mouse

Off

Only

Our

Our Lives

Owe

Pay

Percent

Preach

Returns

Salaries

Serfs

Shares

Small

Something

Spent

Stock

Time

Truth

Truth Is

Us

Wages

War

Related Quotes

The purpose of finance is to enable business to acquire the ownership of capital instruments before it has saved the funds to buy and pay for them. The logic used by business in investing is things that will pay for themselves is not today available to the 95% born without capital. Most of us owe instead of own. And the less the economy needs our labor, the less able we are to "save" our way to capital ownership.

I'd like to help struggling homeowners who can't pay their mortgages, I'd like to invest in our crumbling infrastructure, I'd like to reform the tax system so multimillionaires can't pretend their earnings are capital gains and pay at the rate of 15 percent. I'd like to make public higher education free, and pay for it with a small transfer tax on all financial transactions. I'd like to do much more - a new new deal for Americans. But Republicans are blocking me at every point.

The financial doctrines so zealously followed by American companies might help optimize capital when it is scarce. But capital is abundant. If we are to see our economy really grow, we need to encourage migratory capital to become productive capital - capital invested for the long-term in empowering innovations.

But, my dear, so few things are fulfilled: what are most lives but a series of incompleted episodes? 'We work in the dark, we do what we can, we give what we have. Our doubt is our passion and our passion is our task...' It is wanting to know the end that makes us believe in God, or witchcraft, believe, at least, in something.

I consider myself conscious of how women are treated, and sometimes I can be a feminist. Sometimes I'm a little Republican, sometimes I'm a little Democrat. Sometimes I'm angry, sometimes I'm not angry. I'm not a total feminist, but I believe in rights for females. I believe that if we have to pay 100 percent for our college tuition, and then we get into the workplace and we're only given 70 percent of our counterparts' salaries, then we shouldn't have to pay but 70 percent of our college tuition. Maybe that'll stop the bullshit.

Although it is true that only about 20 percent of American workers are in unions, that 20 percent sets the standards across the board in salaries, benefits and working conditions. If you are making a decent salary in a non-union company, you owe that to the unions. One thing that corporations do not do is give out money out of the goodness of their hearts.

I shall argue that it is the capital stock from which we derive satisfaction, not from the additions to it (production) or the subtractions from it (consumption): that consumption, far from being a desideratum, is a deplorable property of the capital stock which necessitates the equally deplorable activity of production: and that the objective of economic policy should not be to maximize consumption or production, but rather to minimize it, i.e. to enable us to maintain our capital stock with as little consumption or production as possible.

Over the long term, it's hard for a stock to earn a much better return that the business which underlies it earns. If the business earns six percent on capital over forty years and you hold it for that forty years, you're not going to make much different than a six percent return - even if you originally buy it at a huge discount. Conversely, if a business earns eighteen percent on capital over twenty or thirty years, even if you pay an expensive looking price, you'll end up with one hell of a result.