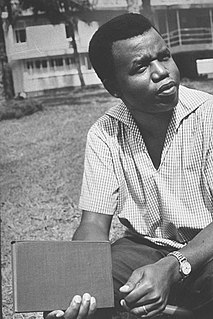

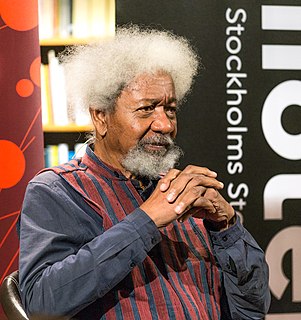

A Quote by Oscar N. Onyema

In Nigeria, financial services, telecoms, and entertainment have driven growth more than oil.

Quote Topics

Related Quotes

Look at me as an example. I don't have the best education or the best looks. Where I'm from in Nigeria is not entertainment driven, it's the northern part of Nigeria and over there they hardly pay attention to entertainment. I came out of that place to attain this level of success. I always say if I can get here with all of these imperfections then no one has the excuse to fail in life.

The foreign companies, especially oil prospects and development companies, have been in Nigeria for about two generations - 40 years and above and so on. So, they know the environment. They stayed that long. They continue to invest because they know the potential Nigeria has in oil and gas and the capacity of the people to learn and work hard.

By any measure, CapitalSource outperformed both our direct competitors and the financial services industry in general, particularly in the context of the near collapse of the financial services industry where 19 of the 20 largest financial institutions in the country either failed or were bailed out by the government.

To change our national economic story from one of financial speculation to one of future growth, we need a third industrial revolution: a green revolution. It will transform our economy as surely as the shift from iron to steel, from steam to oil. It will lead us toward a low-carbon future, with cleaner energy and greener growth. With an economy that is built to last - on more sustainable, more stable foundations

When you talk about the oil wealth you compare nations. There are some nations with less than five million people. Nigeria has 150 million people. I cannot say that all the money earned from oil since 1958, when the first drop of oil was exported from this country to date, that the money has been effectively used.

Mobile phone technology can help to bring financial services to the 80 percent of African women who do not have a bank account and bolster the growth of the world's poorest continent. It's not just about empowering women, it's about economic growth. Unless we can make access to finance easier for women in their businesses, we will be missing out on a significant portion of growth within our economies

They [leaders in Western Europe] do not misuse financial instruments, financial injections, but, first of all, seek structural change. This is urgent for our economy as well, maybe even more urgent bearing in mind the problem that we cannot yet deal with, namely the prevalence of the oil and gas sector in the Russian Federation and, as a result, dependence on revenue from oil and gas.