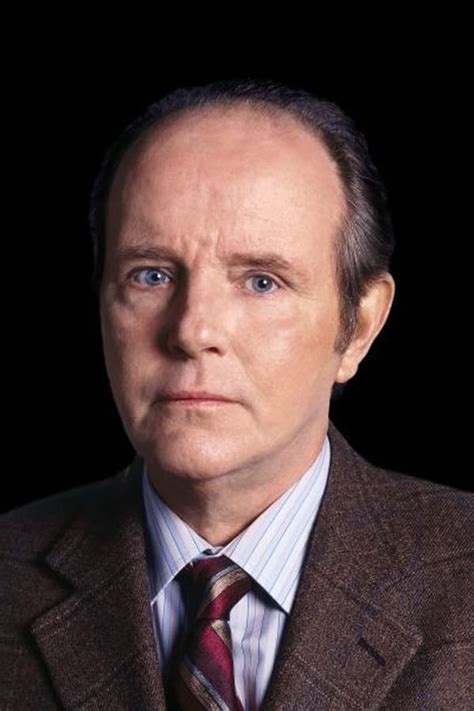

A Quote by Patrick Howley

The Daily Caller has obtained an advance copy of a House Oversight and Government Reform Committee report set to be released Tuesday morning that definitively proves malicious intent by the IRS to improperly block conservative groups that an IRS adviser deemed 'icky.'

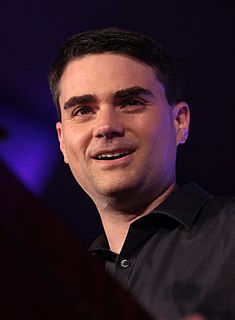

Related Quotes

'The Committee has identified eight senior leaders who were in a position to prevent or to stop the IRS's targeting of conservative applicants,' the Oversight report states. 'Each of these leaders could have and should have done more to prevent the IRS's targeting of conservative tax-exempt applicants.'

Much has already been learned about the arrogance of the IRS from the House investigations of the agency's targeting of conservatives. The revelations emerged despite strenuous efforts by Democrats in Washington and by the IRS itself to block inquiries and deny the existence of political targeting - targeting that the former head of the IRS Exempt Organizations Unit, Lois Lerner, eventually acknowledged and apologized for in May 2013.

Now my poor hometown is being castigated as the center of an IRS scandal. Humble workers at the Cincinnati office targeted Tea Party groups and other conservative organizations for special scrutiny when those groups applied for tax-exempt status. There's no conceivable excuse for that. It was deeply, deeply wrong.

Congress is supposed to fund the IRS, and it has been steadily reducing the number of auditors and tax collectors the IRS has at the very time that the tax system has become vastly more complicated. And of course America continues to grow, so there's an increasing number of tax returns coming in. The IRS responds by doing exactly what Congress expects of them. That shouldn't surprise anyone. All bureaucracies do what they are told.

The British use a system where the profits a corporation reports to shareholders is what they pay taxes on. Whereas in America we require corporations to keep two sets of books, one for shareholders and one for the IRS, and the IRS records are secret. For publicly-traded companies, the British system would tend to align the interests of the government with the interests of the company because the company wants to report the biggest possible profit. Though, all wealthy countries have high taxes as wealth requires lots of common goods, from clean water to public education to a justice system.