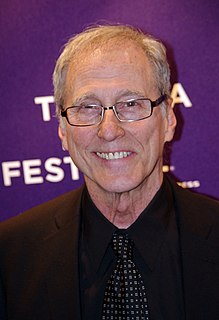

A Quote by Paul Samuelson

Perhaps there really are managers who can outperform the market consistently - logic would suggest that they exist. But they are remarkably well-hidden.

Related Quotes

These results add up to perhaps the most important investment lesson of all that can be drawn from this week's market anniversaries: Predicting turns in the market is incredibly difficult to do consistently well. That means that, if your investment strategy going forward is dependent on your anticipating major market turning points, your chances of success are extremely low.

The idea that a bell rings to signal when investors should get into or out of the stock market is simply not credible. After nearly fifty years in this business, I do not know of anybody who has done it successfully and consistently. I don't even know anybody who knows anybody who has done it successfully and consistently. Yet market timing appears to be increasingly embraced by mutual fund investors and the professional managers of fund portfolios alike.

The mistake managers often make is defining their industry too narrowly. Digital's market share in the minicomputer market stayed very robust even as it fell off the cliff. Disruption seems to come out of nowhere, but if you know what to look for, you can spot important developments well before the market does.

If we are to have a stabilized market demand, selling pressure should be maintained . . . perhaps increased . . .at the first sign of a decline in business. I know of no single way business managers can do more to stabilize market demand than through greater stabilization of sales and advertising expenditures.

People would be a lot more skeptical if they understood that there is an incredible amount of chance in the results that you observe for active managers. So the distribution of outcomes is enormously wide - but that's exactly what you'd expect by chance with lots of active managers who hold imperfectly diversified portfolios. The really good portfolios contain a lot of really lucky picks, and the really bad portfolios contain a lot of really unlucky picks as well as some really bad ones.