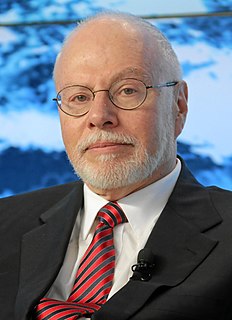

A Quote by Paul Singer

The starting point of my career in money management in 1973-74 was the time of the only true bear market any living non-Japanese investor has seen in major markets. Equities, real estate, you name it, everyone got run over.

Related Quotes

What went wrong is we had tremendous concentration in the sense we put a lot of our money to work against U.S. real estate. We got here by lending money, and putting money to work in the U.S. real estate market, in a size that was probably larger than what we ought to have done on a diversification basis.

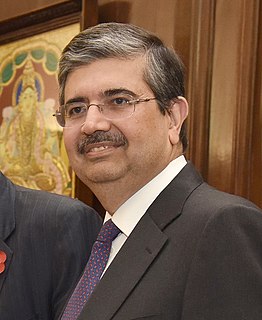

In the 40 years I've been working as an economist and investor, I have never seen such a disconnect between the asset market and the economic reality... Asset markets are in the sky, and the economy of the ordinary people is in the dumps, where their real incomes adjusted for inflation are going down and asset markets are going up.

It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight! It is no trick at all to be right on the market. You always find lots of early bulls in bull markets and early bears in bear markets. I've known many men who were right at exactly the right time, and began buying or selling stocks when prices were at the very level which should show the greatest profit. And their experience invariably matched mine--that is, they made no real money out of it. Men who can both be right and sit tight are uncommon.

Investors, of course, can, by their own behavior make stock ownership highly risky. And many do. Active trading, attempts to "time" market movements, inadequate diversification, the payment of high and unnecessary fees to managers and advisors, and the use of borrowed money can destroy the decent returns that a life-long owner of equities would otherwise enjoy. Indeed, borrowed money has no place in the investor's tool kit.

I believe investors should invest for the long run, so I don't buy and sell. I usually maintain the classic index of global equities, diversified U.S. and global and emerging markets, and when the risk is larger, I diminish the amount in global equities and put more into liquid assets - but very irregularly.

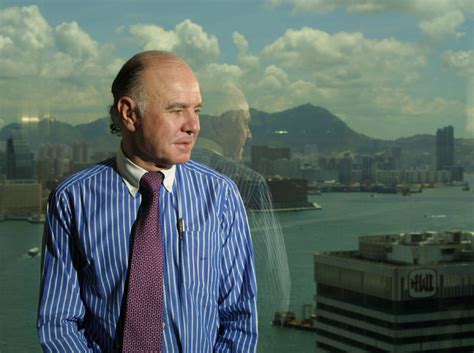

Part of my advantage is that my strength is economic forecasting, but that only works in free markets, when markets are smarter than people. That's how I started. I watched the stock market, how equities reacted to change in levels of economic activity, and I could understand how price signals worked and how to forecast them.

Today the strategies of many companies in the real estate industry are premised on low interest rates, an assumption that has resulted in the rapid expansion of the real estate securitization business. This trend could be regarded as a risk factor, as it exposes the real estate sector to at least three potential problems: first, interest rate hikes; second, revisions to securitization business accounting standards; and third, overheating in the real estate market.