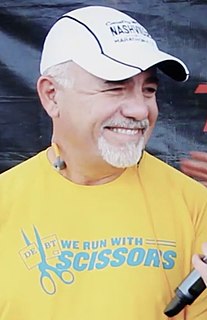

A Quote by Rush Limbaugh

This is a derivative, if you will, of Cloward-Piven [theory]. "[Stephen] Lerner's plan is to organize a mass, coordinated 'strike' on mortgage, student loan, and local government debt payments - thus bringing the banks to the edge of insolvency and forcing them to renegotiate the terms of the loans.

Related Quotes

A consolidation makes sense only if you can lower your overall interest rate. Many people consolidate by taking out a home equity line loan or home equity line of credit (HELOC), refinancing a mortgage, or taking out a personal loan. They then use this cheaper debt to pay off more expensive debt, most frequently credit card loans, but also auto loans, private student loans, or other debt.

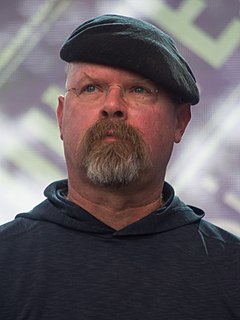

Debt is so ingrained into our culture that most Americans can't even envision a car without a payment ... a house without a mortgage ... a student without a loan ... and credit without a card. We've been sold debt with such repetition and with such fervor that most folks can't conceive of what it would be like to have NO payments.

Both HUD and the Department of Justice began bringing lawsuits against mortgage bankers when a higher percentage of minority applicants than white applicants were turned down for mortgage loans. A substantial majority of both black and white mortgage loan applicants had their loans approved but a statistical difference was enough to get a bank sued.

The current U.S. and Eurozone depression isn't because of China. It's because of domestic debt deflation. Commodity prices and consumer spending are falling, mainly because consumers have to pay most of their wages to the FIRE sector for rent or mortgage payments, student loans, bank and credit card debt, plus over 15 percent FICA wage withholding for Social Security and Medicare actually, to enable the government to cut taxes on the higher income brackets, as well income and sales taxes.

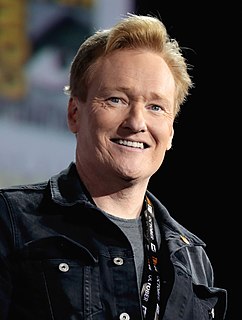

Student debt is crushing the lives of millions of Americans. How does it happen that we can get a home mortgage or purchase a car with interest rates half of that being paid for student loans? We must make higher education affordable for all. We must substantially lower interest rates on student loans. This must be a national priority.

The fact that you have government-guaranteed student loans has created a whole new sector in the American economy that didn't really exist before - private for-profit universities that sell junk degrees that don't help the students. They promise the students, "We'll help you get a better job. We'll arrange a loan so that you don't have to pay a penny for this education." Their pet bank gets them the government-guaranteed loan, and the student may get the junk degree, but doesn't get a job, so they don't pay the loan.

In housing you have jingle mail and you can walk away and leave the bank holding the bag. In the case of student loans, the debt follows you through life, and the banks or government will turn it over to collection agencies that are not very nice people and can do all sorts of harassing things to you. It's becoming a nightmare.