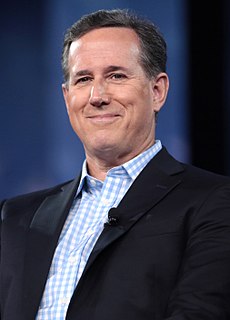

A Quote by Rick Santorum

Well, higher-income people don't have to pay taxes if they don't want to because they can move their money somewhere else, they can move their investments. They can stop investing. They can stop working. They don't need to work. They're higher-income people.

Related Quotes

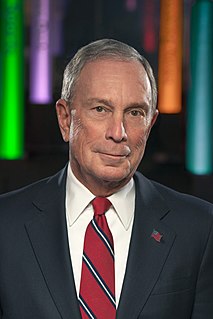

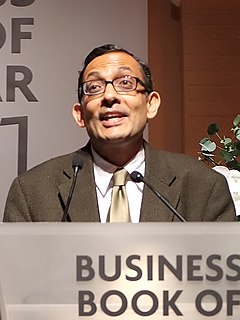

When you say the tax system benefits the rich, there are a lot of people who respond, "That can't be true, look at the rate of tax. The people who are rich pay a higher rate than you or I." Well, yeah, but if you don't have to pay taxes on a lot of your income, then your real tax rate is a lot lower. And if you're allowed to pay your taxes thirty years from now instead of today then you're a lot better off. People need to have a sophisticated understanding of how the system works to appreciate that the posted tax rate really has very little to do with the taxes people pay.

The current U.S. and Eurozone depression isn't because of China. It's because of domestic debt deflation. Commodity prices and consumer spending are falling, mainly because consumers have to pay most of their wages to the FIRE sector for rent or mortgage payments, student loans, bank and credit card debt, plus over 15 percent FICA wage withholding for Social Security and Medicare actually, to enable the government to cut taxes on the higher income brackets, as well income and sales taxes.

By the standards of honest, if unorthodox, accounting, government workers don't pay taxes, but are paid out of taxes. In other words, they pay taxes out of money confiscated from taxpayers, who, in turn, pay taxes twice: on their own income and on the income of members of the bureaucracy. At the very least, this should disqualify state workers from voting.

If I'm owed money, but I say, 'Don't pay me, pay my cousin. Don't pay me, pay my charity,' you can do that, but then the IRS requires that you pay income tax on that. It's your income if you earned it and you directed where it went. If you exercised control over where the money went, you have to pay income tax on that.

Donald Trump is a - the owner of a lot of real estate that he manages, he may well pay no income taxes. We know for a fact that he didn't pay any income taxes in 1978, 1979, 1984, 1992 and 1994. We know because of the reports of the New Jersey Casino Control Commission. We don't know about any year after that.

Your profits are going to be cut down to a reasonably low level by taxation. Your income will be subject to higher taxes. Indeed in these days, when every available dollar should go to the war effort, I do not think that any American citizen should have a net income in excess of $25,000 per year after payment of taxes.

Why do we need to support the food stamp program? Because low-income families experience unemployment at a far higher rate than other income groups. Because cutting nutritional assistance programs is immoral and shortsighted, and protecting families from hunger improves their health and educational outcomes.

I don't know a lot of writers, even writers who have been on the bestseller list for a few weeks, or writers who have gotten movie options, who can live on just their writing income. Once you break it down to the years it took to write the book, place it, promote it, and you pay the agent, pay the taxes, the annual income is not enough to live on comfortably. I do not have a starving artist inclination. I'm from the working class. I don't feel creative unless I feel like my house is going to be there and I'm going to be fed. I can't worry about money and write. Maybe some people can.