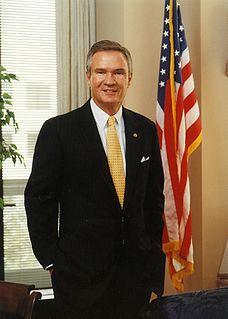

A Quote by Richard Neal

We could quite easily, Republicans and Democrats working together, do something that everybody in America desires, and that is a simplification of our Tax Code.

Related Quotes

The Democrats and Republicans need to come together. I've criticized Democrats for their unwillingness to address entitlement reform and Social Security and Medicare. Republicans, on the other hand, never saw a tax that they liked, even when it meant closing tax loopholes. They don't want to in any way support any revenue enhancements.

We need to lower tax rates for everybody, starting with the top corporate tax rate. We need to simplify the tax code. The ultimate answer, in my opinion, is the fair tax, which is a fair tax for everybody, because as long as we still have this messed-up tax code, the politicians are going to use it to reward winners and losers.

We need to enact fundamental tax reform. The weight and complexity of our 73,000-page tax code are crushing everyday Americans. We need to radically simplify the tax code so that we can re-start the real engine of growth in our economy. That means our tax code needs to go from 73,000 pages down to about three pages.

I think that taxes would be fair if we first get rid of the tax code. This is the ultimate solution, not to just say we're going to trim around the edges, not to say that we will try to simplify a little of this and a little of that. The problem is, replace the tax code, so we can establish tax fairness for everybody.

Every presidential candidate for decades has released his tax returns, and I've released 33 years of my tax returns. The American people deserve to know about our taxes. And so Donald Trump is standing in the way of precedent that goes back on both sides of aisle Democrats and Republicans, and he clearly has something that he doesn't want us to see.

We certainly could have voted on making the middle-class tax cuts and tax cuts for working families permanent had the Republicans not insisted that the only way they would support those tax breaks is if we also added $700 billion to the deficit to give tax breaks to the wealthiest 2 percent of Americans. That's what was really disturbing.

We've got a tax code that is encouraging flight of jobs and outsourcing. And that's why we've specifically recommended in this campaign that Congress change our tax code so that we stop giving tax breaks to companies that are moving to Mexico and China and other places, and start putting those tax breaks into companies that are investing here in the United States.