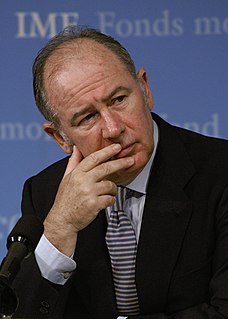

A Quote by Rodrigo Rato

We believe that the Federal Reserve has to carry on with a progressive increase in interest rates as a consequence of the American economy.

Related Quotes

Since 2008 you've had the largest bond market rally in history, as the Federal Reserve flooded the economy with quantitative easing to drive down interest rates. Driving down the interest rates creates a boom in the stock market, and also the real estate market. The resulting capital gains not treated as income.

I mean, I'm a conservative. I believe that, you know, if you borrow too much, you just build up debts for your children to pay off. You put pressure on interest rates. You put at risk your economy. That's the case in Britain. We're not a reserve currency, so we need to get on and deal with this issue.

A higher IOER rate encourages banks to raise the interest rates they charge, putting upward pressure on market interest rates regardless of the level of reserves in the banking sector. While adjusting the IOER rate is an effective way to move market interest rates when reserves are plentiful, federal funds have generally traded below this rate.

I don't think it's possible for the Fed to end its easy-money policies in a trouble-free manner. Recent episodes in which Fed officials hinted at a shift toward higher interest rates have unleashed significant volatility in markets, so there is no reason to suspect that the actual process of boosting rates would be any different. I think that real pressure is going to occur not by the initiation by the Federal Reserve, but by the markets themselves.