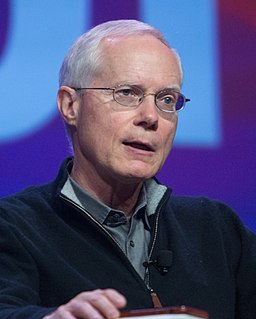

A Quote by Ron Chernow

Mutual funds have historically offered safety and diversification. And they spare you the responsibility of picking individual stocks.

Related Quotes

Invest in low-turnover, passively managed index funds... and stay away from profit-driven investment management organizations... The mutual fund industry is a colossal failure... resulting from its systematic exploitation of individual investors... as funds extract enormous sums from investors in exchange for providing a shocking disservice... Excessive management fees take their toll, and manager profits dominate fiduciary responsibility.

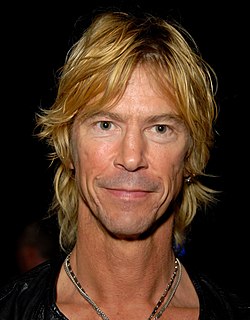

I don't invest in the stock market. I did it a long, long time ago when I was really young, and I got involved in all the investigations and all the prosecutions, and I felt it was better if I didn't make individual investments. So I'm invested in funds, but not in individual - not in individual stocks.