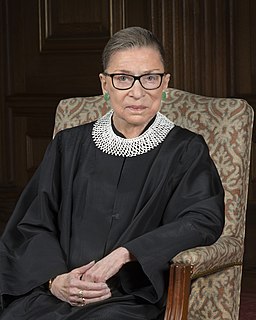

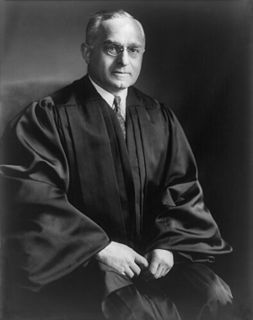

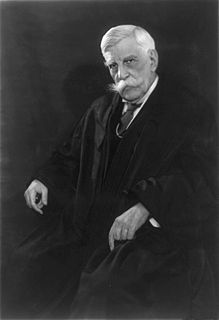

A Quote by Ruth Bader Ginsburg

People who have been hardworking, tax paying, those people ought to be given an opportunity to be on a track that leads towards citizenship and if that happened, then they wouldn't be prey to the employers who say we want you because we know that you work for a salary we could not lawfully pay anyone else.

Related Quotes

People who have been hardworking, tax paying, those people ought to be given an opportunity to be on a track that leads towards citizenship, and if that happened, then they wouldn't be prey to the employers who say, 'We want you because we know that you work for a salary we could not lawfully pay anyone else.'

I don't know how you feel, but I'm pretty sick of church people. You know what they ought to do with churches? Tax them. If holy people are so interested in politics, government, and public policy, let them pay the price of admission like everybody else. The Catholic Church alone could wipe out the national debt if all you did was tax their real estate.

Fewer and fewer people are paying larger and larger percentage of the tax burden, as you know, almost half the people pay no income taxes at all. We're going to have more people in the wagon than we got pulling the wagon before long and that's not going to work. Those jobless numbers, you know, go hand-in-hand with those tax numbers.

And it’s all my fault, Gale. Because of what I did in the arena. If I had just killed myself with those berries, none of this would’ve happened. Peeta could have come home and lived, and everyone else would have been safe, too.” “Safe to do what?” he says in a gentler tone. “Starve? Work like slaves? Send their kids to the reaping? You haven’t hurt people – you’ve given them an opportunity. They just have to be brave enough to take it.

When you say the tax system benefits the rich, there are a lot of people who respond, "That can't be true, look at the rate of tax. The people who are rich pay a higher rate than you or I." Well, yeah, but if you don't have to pay taxes on a lot of your income, then your real tax rate is a lot lower. And if you're allowed to pay your taxes thirty years from now instead of today then you're a lot better off. People need to have a sophisticated understanding of how the system works to appreciate that the posted tax rate really has very little to do with the taxes people pay.

We were giving advice for the single-worst idea to come forward from a group that's been rife with them, it would be this: The idea is this: Let's make the tax code of America better for very rich people; let's give substantial tax relief to the richest people we can find. Forget about the person making $40,000 a year and paying Social Security payroll tax. Forget about all those other people paying income tax; we're here to give tax relief to the richest 2% of America.

If you closed your eyes during that [Donald Trump] conference and you didn`t pay attention to who was saying those words, it could have been Jeb Bush saying those words last year, Jeb Bush. It could have been Marco Rubio saying those words last year during the primaries, because that`s the position of, well, those two Floridians, you know, no pathway to citizenship according to Jeb Bush, pathway to citizenship in the long term, according to Marco Rubio, but talking about the need to brush up on the border.

You can’t say ‘if this didn’t happen then that would have happened’ because you don’t know everything that might have happened. You might think something’d be good, but for all you know it could have turned out horrible. You can’t say ‘If only I’d…’ because you could be wishing for anything. The point is, you’ll never know. You’ve gone past. So there’s no use thinking about it.

I'm always amazed that anyone is paying attention to anything that I do, you know what I mean? I feel like I'm constantly having conversations with people where they're saying, "I didn't know that you could be serious," and then other people are saying, "Oh, I didn't know that you could do comedy." And so I don't know if it really helped too much with this. I like to think that it does.

Millions and millions of people don't pay an income tax, because they don't earn enough to pay on one, but you pay a land tax whether it ever did or ever will earn you a penny. You should pay on things that you buy outside of bare necessities. I think this sales tax is the best tax we have had in years.

Basic US economics tells us that back-of-the-house workers are very unlikely to get more pay overall. The fact that workers are in those jobs means employers are already paying them what they need to pay them to get them in the current environment. If employers do share some tips with them, it will likely be offset by a reduction in their base pay.

Most employers I speak to, they want to create jobs and give decent salaries. Some small and medium companies say to me they cannot afford to pay the living wage. I say "what about if I gave you a business rate cut?" and they say, yes, ok. We want companies which are skilled up, generating more profit, more corporation tax - we should not be embarrassed at success, as long as they pay their taxes.