A Quote by Sebastian Kurz

Taking money in taxes and paying it straight back in subsidies is wrong.

Related Quotes

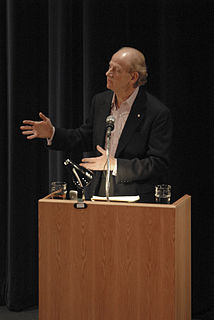

I'm making a lot of money. I should be paying a lot more taxes. I'm not paying taxes at a rate that is even close to what people were paying under Eisenhower. Do people think America wasn't ascendant and wasn't an upwardly mobile society under Eisenhower in the '50s? Nobody was looking at the country then and thinking to themselves, "We're taxing ourselves into oblivion." Yet there isn't a politician with balls enough to tell that truth because the whole system has been muddied by the rich. It's been purchased.

In one week, I went from being a girl who owed a guy thousands of dollars - my manager Anthony was paying for my outfits, paying for my food; I was sleeping in his parents' basement - to taking meetings with every major label in America. The next morning, I had a record deal and wrote him a cheque to pay back all that money.

I've never had it so good in terms of taxes. I am paying the lowest tax rate that I've ever paid in my life. Now, that's crazy. And if you look at the Forbes 400, they are paying a lower rate, accounting payroll taxes, than their secretary or whomever around their office. On average. And so I think that actually people in my situation should be paying more tax. I think the rest of the country should be paying less.

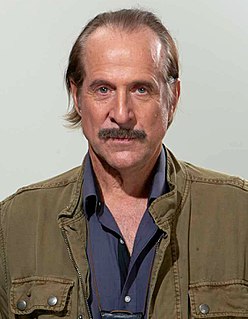

A lot of people in the western world don't realize how much taxes limit their options. You can end up paying almost half your income in taxes, which basically means you're working for the government for 180 days a year. I think I can find better ways to use the money I make for the benefit of society.