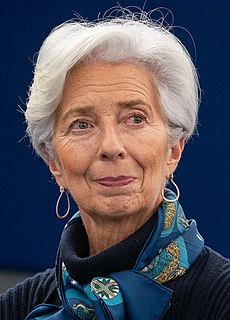

A Quote by Shinzo Abe

I often say to entrepreneurs, 'If Lehman Brothers were Lehman Brothers & Sisters, it wouldn't have gone into bankruptcy.'

Quote Topics

Related Quotes

In truth, in the fairy-tale version of bailing out Lehman, the next domino, A.I.G., would have fallen even harder. If the politics of bailing out Lehman were bad, the politics of bailing out A.I.G. would have been worse. And the systemic risk that a failure of A.I.G. posed was orders of magnitude greater than Lehman's collapse.

In September 2008 - as Lehman Brothers filed for bankruptcy and AIG, the world's biggest insurance company, accepted a federal bailout - Senator John McCain of Arizona, in what was widely viewed as a political move, suspended his presidential campaign and called on Obama to rush back to Washington for a bipartisan meeting at the White House.

Hey, guess what? Turns out the free market? Not so free. Wall Street was hit hard Monday when Lehman Brothers filed for bankruptcy, Merrill Lynch was sold to Bank of America, and insurance giant AIG neared a collapse of its own. Basically, if your commercials air during golf tournaments, you're done.