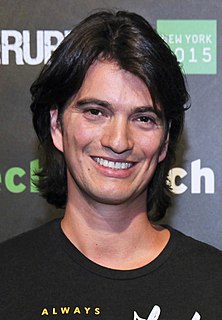

A Quote by Stelios Haji-Ioannou

I see easyHotel as one of the best, most natural extensions of the 'easy' brand from the airline. EasyHotel is raising money to accelerate growth at a much faster rate than I could have grown it as a private company, whilst enabling me to spend more time on my diversified portfolio of other investments.

Related Quotes

It's more important than ever to define yourself in terms of what you stand for rather than what you make, because what you make is going to become outmoded faster than it has at any time in the past. ...hang on to the idea of who you are as a company, and focus not on what you do, but on what you could do. By being really clear about what you stand for and why you exist, you can see what you could do with a much more open mind. You enhance your ability to adapt to change.

The private sector is first of all much larger than the public sector. The waste we see in that sector does not result from the fact that people spend their money carelessly. Mostly, it occurs because what one family must spend to achieve its goals often depends heavily on what other families spend.

The growth of the American food industry will always bump up against this troublesome biological fact: Try as we might, each of us can only eat about fifteen hundred pounds of food a year. Unlike many other products - CDs, say, or shoes - there's a natural limit to how much food we each can consume without exploding. What this means for the food industry is that its natural rate of growth is somewhere around 1 percent per year - 1 percent being the annual growth rate of American population. The problem is that [the industry] won't tolerate such an anemic rate of growth.

The best way to encourage economic vitality and growth is to let people keep their own money.When you spend your own money, somebody's got to manufacture that which you're spending it on. You see, more money in the private sector circulating makes it more likely that our economy will grow. And, incredibly enough, some want to take away part of those tax cuts. They've been reading the wrong textbook. You don't raise somebody's taxes in the middle of a recession. You trust people with their own money. And, by the way, that money isn't the government's money; it's the people's money.

Whether government finances its added spending by increasing taxes, by borrowing, or by inflating the currency, the added spending will be offset by reduced private spending. Furthermore, private spending is generally more efficient than the government spending that would replace it because people act more carefully when they spend their own money than when they spend other people's money.

I am actually quite encouraged and I think, actually, the UK is coping with globalisation a lot better than most other European countries. And that is reflected in the fact that (whilst of course there are people who are still unemployed) our unemployment rate is low and (whilst of course we need to export more) we are attracting a huge amount of inward investment into Britain.

The rate of growth of the relevant population is much greater than the rate of growth in funds, though funds have gone up very nicely. But we have been producing students at a rapid rate; they're competing for funds and therefore they're more frustrated. I think there's a certain sense of weariness in the intellectual realm, it's not in any way peculiar to economics, it's a general proposition.

Criticism of growth arose with the discovery that growth beyond a certain point is destructive of the earth. We are already using resources much faster than they can be replenished. We are producing wastes much faster than nature's sinks can process them. The growth economy will end. The only questions are when its end will come, and whether humanity will be able to survive its demise.