A Quote by Bill Gross

Bonds despite their ridiculous yields will not easily be threatened with a new bear market.

Quote Topics

Related Quotes

As a bull market turns into a bear market, the new pros turn into optimists, hoping and praying the bear market will become a bull and save them. But as the market remains bearish, the optimists become pessimists, quit the profession, and return to their day jobs. This is when the real professional investors re-enter the market.

And so in 1975, the grizzly bear was put on, as I said - on the endangered species list as threatened. And new measures were taken, for instance, bear-proofing garbage, creating new regulations to - essentially to try and keep people and people's food away from the bears, let the bears adjust to eating the abundant wild food that's available in Yellowstone and allow them to be more wild, to be independent of humans as sources of foods for the good of both sides. And that has been quite successful.

Near the top of the market, investors are extraordinarily optimistic because they've seen mostly higher prices for a year or two. The sell-offs witnessed during that span were usually brief. Even when they were severe, the market bounced back quickly and always rose to loftier levels. At the top, optimism is king, speculation is running wild, stocks carry high price/earnings ratios, and liquidity has evaporated. A small rise in interest rates can easily be the catalyst for triggering a bear market at that point.

There's a lot of research that suggests that organic yields are close or superior to conventional yields depending on factors like climate. In a drought year an organic field of corn will yield more - considerably more - than a conventional field; organic fields hold moisture better so they don't need as much water. It simply isn't true that organic yields are lower than conventional yields.

There are several things that can create an alpha - stock buybacks are one. High dividend yields are another, especially nowadays because the stock market yields more than the banks and the tenure treasury. But by and large, it tends to be companies with a strong cash flow, rising sales, accelerated earnings, a profit margin expansion.

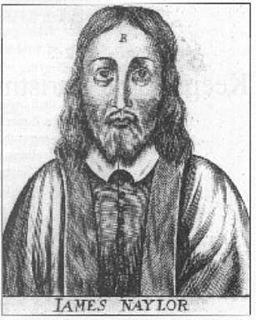

Wherefore give all diligence to the Spirit's motion and leadings, what it moves against, and what it leads to; for now will God make all things new: A new creation, new heavens, and new earth, and new heart and mind, and a new law, a new man to walk therein with his Maker with cheerfulness, and the old bonds are broken by the Spirit's leading, and to serve in newness of spirit.

An old market had stood there until I'd been about six years old, when the authorities had renamed it the Olde Market, destroyed it, and built a new market devoted to selling T-shirts and other objects with pictures of the old market. Meanwhile, the people who had operated the little stalls in the old market had gone elsewhere and set up a thing on the edge of town that was now called the New Market even though it was actually the old market.

Perhaps it won't matter, in the end, which country is the sower of the seed of exploration. The importance will be in the growth of the new plant of progress and in the fruits it will bear. These fruits will be a new breed of the human species, a human with new views, new vigor, new resiliency, and a new view of the human purpose. The plant: the tree of human destiny.