A Quote by Sam Altman

Related Quotes

What we've done last night is what I call pushing back the risks..If there is a risk in a bank, our first question should be 'Okay, what are you in the bank going to do about that? What can you do to recapitalise yourself? If the bank can't do it, then we'll talk to the shareholders and the bondholders, we'll ask them to contribute in recapitalising the bank, and if necessary the uninsured deposit holders.

A lot of the Russian economy is built around people who are one way or another milking the state and taking money from the state and recycling it into their private bank accounts. And there are a lot of people who are taking advantage of that, so it's not just one person. It's a kind of web of people doing that, and that's how the system stays in power and how people stay in control.

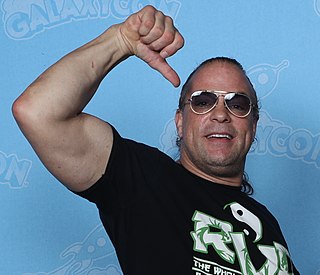

When we were young, there weren't very many smart people in the investment world. You should have seen the people in the bank trust departments. Now, there are armies of smart people at private investment funds, etc . If there were a crisis now, there would be a lot more people with a lot of money ready to take advantage.

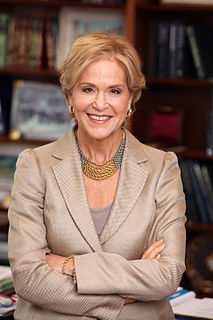

I'd like to see feminism really be more loving. Feminists have a lot of righteous anger, and have done a lot to fight for rights. But we need a lot of love and compassion - to embrace people, to educate people. I wasn't a feminist until l I was educated about what it was. I would love to see men attend, and transgender people. Everyone is welcome.