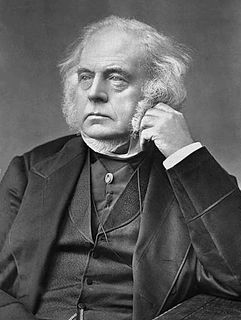

A Quote by Samuel Johnson

Excise: A hateful tax levied upon commodities, and adjudged not by the common judges of property, but wretches hired by those to whom excise is paid.

Related Quotes

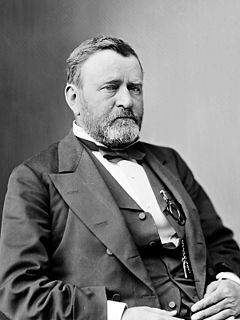

As to the Income Tax, my opinion is that the needful revenue would be fairly and most fairly raised if paid by property, and by individuals in proportion to their property. A Property Tax should be an assessment upon all land and buildings, and canals and railroads, but not on property such as machinery, stock in trade, etc. The aristocracy have squeezed all they can out of the mass of the consumers, and now they lay their daring hands on those not wholly impoverished.

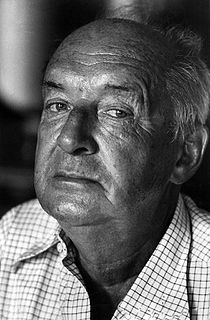

Politicians like to talk about the income tax when they talk about overtaxing the rich, but the income tax is just one part of the total tax system. There are sales taxes, Medicare taxes, social security taxes, unemployment taxes, gasoline taxes, excise taxes - and when you add up all of those taxes [many of which are quite regressive], and then you look at how they affect the rich and the poor, you essentially end up with a system in which the best off 20 percent of Americans pay one percentage point more of their income than the worst off 20 percent of Americans.

Hillary Clinton has decided to line up with John McCain in pushing to suspend the federal excise tax on gasoline, 18.4 cents a gallon, for this summer's travel season. This is not an energy policy. This is money laundering: we borrow money from China and ship it to Saudi Arabia and take a little cut for ourselves as it goes through our gas tanks. What a way to build our country.

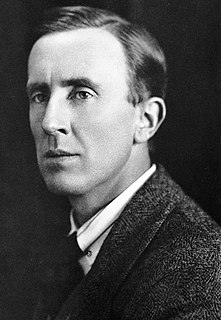

What it 't to us, if taxes rise or fall,

Thanks to our fortune, we pay none at all.

Let muckworms who in dirty acres deal,

Lament those hardships which we cannot feel,

His grace who smarts, may bellow if he please,

But must I bellow too, who sit at ease?

By custom safe, the poets' numbers flow,

Free as the light and air some years ago.

No statesman e'er will find it worth his pains

To tax our labours, and excise our brains.

Burthens like these with earthly buildings bear,

No tributes laid on castles in the air.