A Quote by Tyler Cowen

In truth, it's not the shareholders of the American International Group who benefited most from its bailout; they were mostly wiped out. The great beneficiaries have been the creditors and counterparties at the other end of A.I.G.'s derivatives deals - firms like Goldman Sachs, Merrill Lynch, Deutsche Bank, Societe Generale, Barclays and UBS.

Related Quotes

Goldman Sachs was fundamentally responsible for the crash of 2008, but by that time its former Chairman and Chief Executive Officer, Henry 'Hank' Paulson, had been installed as US Treasury Secretary to begin the bank bail out policy, with enormous benefit to Goldman Sachs, in the closing weeks of the Bush administration. Goldman Sachs was also instrumental in the collapse of the economy in Greece that started the 'euro panic' that later engulfed Ireland.

The dirty little secret of what used to be known as Wall Street securities firms-Goldman Sachs, Morgan Stanley, Merrill Lynch, Lehman Brothers, and Bear Stearns-was that every one of them funded their business in this way to varying degress, and every one of them was always just twenty-four hours away from a funding crisis. The key to day-to-day survival was the skill with which Wall Street executives managed their firms' ongoing reputation in the marketplace.

So Merrill Lynch has launched its first campaign in years to advertise the accomplishments of its investment banking business. The ads feature things like Merrill's recapitalization of Sierra Pacific. I guess including "helping Enron achieve its earnings goals in 1999" might be a little awkward given that Merrill Lynch bankers are currently on trial in Houston for that "accomplishment."

Goldman Sachs was one of those companies whose illegal activity helped destroy our economy and ruin the lives of millions of Americans. But this is what a rigged economy and a corrupt campaign finance system and a broken criminal justice is about. These guys are so powerful that not one of the executives on Wall Street has been charged with anything after paying, in this case of Goldman Sachs, a $5 billion fine.

What's the best gamble in the world, right now? Its betting that Deutsche Bank stock is going to go down. Short sellers borrowed money from their banks to place bets that Deutsche Bank stock is going to go down. Now, it's wringing its hands and saying, "Oh the speculators are killing us." But it's Deutsche Bank and the other banks that are providing the money to the speculators to bet on credit.

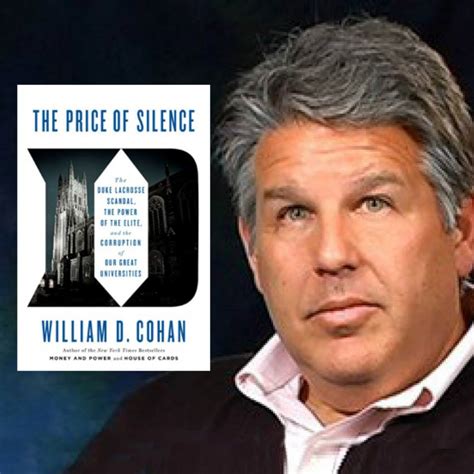

Because I wrote a book about Goldman Sachs. And I know that, from talking to people at Goldman Sachs, that Trump is the poster child for the kind of client they don't want to do business with, mainly because he would borrow all this money from Wall Street to build his casinos, and then didn't pay it back.

Generally speaking, they have as many stars as other firms, but they are low-key about it, because that's not the Goldman way, but their bench is a lot deeper. I think Goldman has as many A players, but more importantly they have fewer C players. And no firm, I have noticed, has the depth anywhere like that.