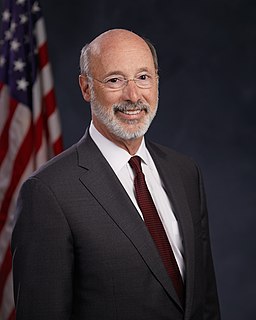

A Quote by Tom Wolf

The extraction tax is based in part on production times the market value at the wellhead, so any downturn in the market price is going to be a mathematical impact on the shale tax. But beyond that, it also concerns me because it also impacts the health of the industry.

Related Quotes

The latest trade of a security creates a dangerous illusion that its market price approximates its true value. This mirage is especially dangerous during periods of market exuberance. The concept of "private market value" as an anchor to the proper valuation of a business can also be greatly skewed during ebullient times and should always be considered with a healthy degree of skepticism.

The Value-Added Tax, a sales tax that applies at every level of business transactions, is an easy tax for governments to collect, and a hard tax to evade. So it makes the job of raising revenue easier. The revenues from the VAT can then be used to lower taxes on income and saving and investment. The Value-Added tax doesn't penalize work or saving; it's a tax on buying stuff.

In the eyes of many business leaders, there is never an opportune moment for tax reform. Yes, the economy is losing momentum, but that is not because a handful of people are losing their privileges. Slow growth did not first begin during my term in office; the market downturn is making itself felt around the world. My government has responded with an agenda aimed at raising productivity. We are also investing substantially in infrastructure - the plan calls for €20.5 billion or $26.3 billion by 2021.

Value in relation to price, not price alone, must determine your investment decisions. If you look to Mr Market as a creator of investment opportunities (where price departs from underlying value), you have the makings of a value investor. If you insist on looking to Mr Market for investment guidance however, you are probably best advised to hire someone else to manage your money.

In the domain of pharmaceuticals, we need a metric for health impact, and with this metric we can then assess the value of the introduction of a new product and pay its innovator accordingly, say on the basis of the product's measured health impact during its first ten years on the market. In exchange, innovators must of course renounce the usual rewards they are otherwise entitled to, namely the patent-protected markup on the price of their product.

Outside the firm, price movements direct production, which is co-ordinated through a series of exchange transactions on the market. Within a firm, these market transactions are eliminated and in place of the complicated market structure with exchange transactions is substituted the entrepreneur-co-ordinator, who directs production.

I've obviously come from a health background. I was a doctor before I became a pollie and one of the things I'd like to do is to really build on the world-class health system we've got. I'm passionate about climate change because it's also a health issue. Things like extreme weather impact on people's health, the ability of our hospitals to cope, the impact on mental health, on farmers in regional areas - they're all serious health concerns.

We need to lower tax rates for everybody, starting with the top corporate tax rate. We need to simplify the tax code. The ultimate answer, in my opinion, is the fair tax, which is a fair tax for everybody, because as long as we still have this messed-up tax code, the politicians are going to use it to reward winners and losers.