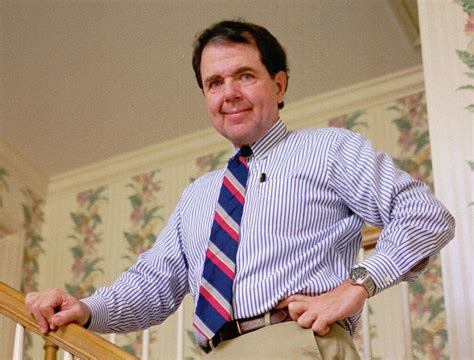

A Quote by Thomas J. Stanley

Multiply your age times your realized pretax annual household income from all sources except inheritances. Divide by ten. This, less any inherited wealth, is what your net worth should be.

Related Quotes

Your profits are going to be cut down to a reasonably low level by taxation. Your income will be subject to higher taxes. Indeed in these days, when every available dollar should go to the war effort, I do not think that any American citizen should have a net income in excess of $25,000 per year after payment of taxes.

One of the dangers about net-net investing is that if you buy a net-net that begins to lose money your net-net goes down and your capacity to be able to make a profit becomes less secure. So the trick is not necessarily to predict what the earnings are going to be but to have a clear conviction that the company isn't going bust and that your margin of safety will remain intact over time.

The single observation I would offer for your consideration is that some things are beyond your control. You can lose your health to illness or accident. You can lose your wealth to all manner of unpredictable sources. What are not easily stolen from you without your cooperation are your principles and your values. They are your most important possessions and, if carefully selected and nurtured, will well serve you and your fellow man.

If you're a wealthy heir with a trust fund, and you sell stocks, make your 10% gains since Donald Trump, and then you buy other stocks, you can avoid paying taxes. And if your accountant registers your wealth offshore in a Panamanian fund, like Russian kleptocrats do - and as more and more Americans do - you don't have to pay any tax at all, because it's not American income, it's foreign income in an enclave without an income tax.